Lombardi Letter/Moe Zulfiqar/7-27-2022

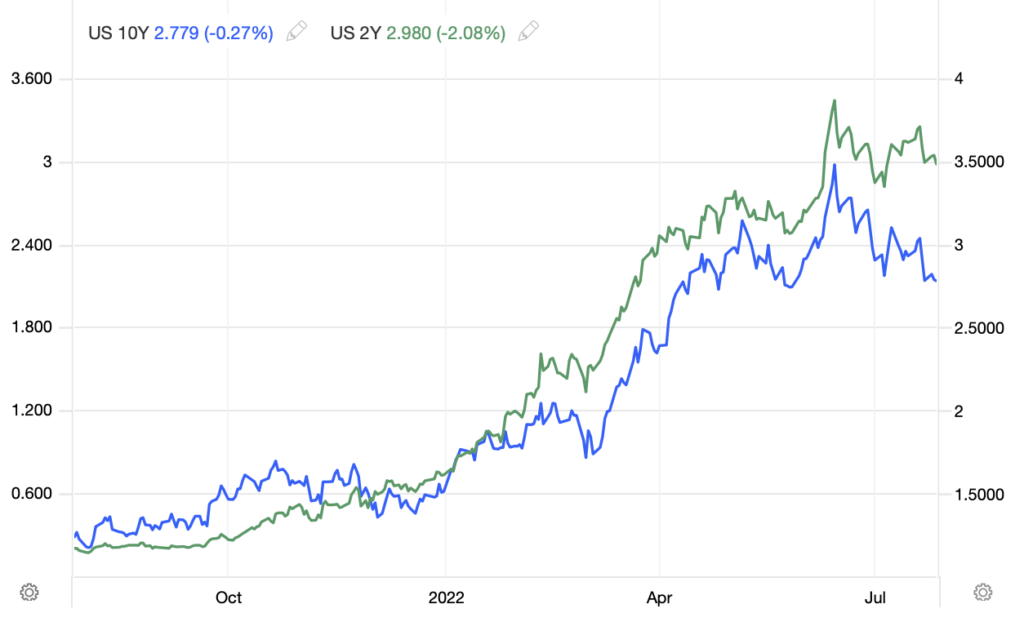

Chart courtesy of TradingEconomics.com

“Year-to-date, the price of gold is down by close to six percent, and it wouldn’t be shocking if the yellow precious metal goes a bit lower in the near term. This could be a blessing in disguise for those who are looking to invest in gold for the long term. The future of the yellow precious metal looks shiny. Gold prices could be a lot higher a few years from now.”

USAGOLD note: The Lombardi Letter sees the inverted yield as an important buying opportunity. “Historically speaking,” it says, “if you buy gold when the yield curve inverts and hold that gold for 36 months (three years), you’ll make a solid return. Not only do we have an inversion, it is very pronounced as you can see in the chart above.