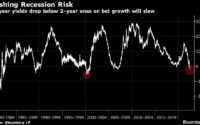

Services PMI Signals “Strong Likelihood” Of 3rd Straight Quarterly US GDP Contraction

After both ISM and S&P Global Manufacturing Surveys showed continued weakness in July, analysts expected both Services Surveys to show further deterioration also – they were right and wrong.

-

S&P Global US Services PMI fell from 52.7 to 47.3 in July (slightly above the flash print of 47.0). The contractionary signal is the lowest since June 2020.

-

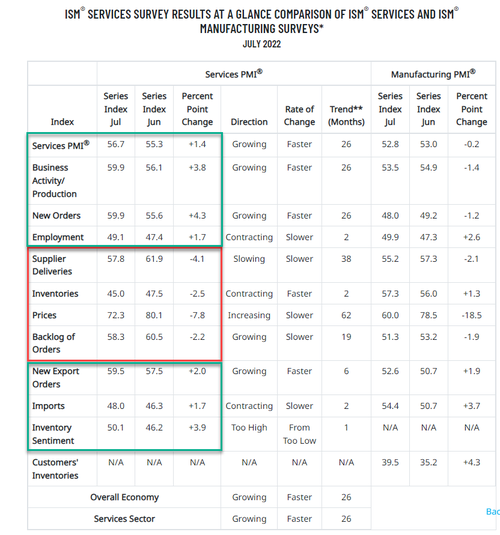

ISM Services rose from 55.3 to 56.7 in July (well above the 53.5 expected)

Source: Bloomberg

While S&P Global sees new orders, activity, and employment all falling, ISM somehow sees them all rebounding in July…

Among comments from ISM respondents

-

“Interest rates have significantly impacted the homebuilding market. Cancellation rates have increased, as homebuyers can no longer afford the monthly payment. Traffic to our communities is down. Inflation has sidelined many would-be buyers.” [Construction]

-

“Can feel the economy weakening. Clients are making appropriate moves in anticipation of a recession.” [Management of Companies & Support Services]

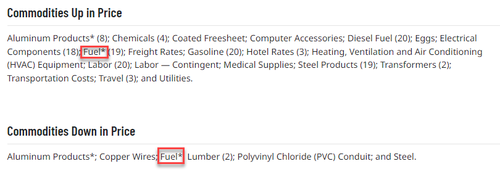

And just to add the fucking farce, Fuel prices are both up and down…

Anyone else think they might just be making this shit up?

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

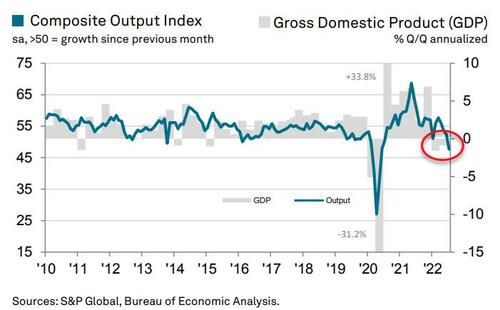

“US economic conditions worsened markedly in July, with business activity falling across both the manufacturing and service sectors. Excluding pandemic lockdown months, the overall fall in output was the largest recorded since the global financial crisis and signals a strong likelihood that the economy will contract for a third consecutive quarter.

“Tightening financial conditions mean the financial services sector is leading the downturn, with a further steep rise in interest rates from the FOMC since the survey data were collected likely to intensify the downturn. Higher interest rates, alongside the ongoing surge in inflation, have meanwhile spilled over to the consumer sector, meaning the surge in household spending on goods and activities such as travel, tourism, hospitality and recreation seen in the spring has now moved into reverse as household spending is diverted to essentials.

“Although employment continued to rise in July, the rate of job creation has also slowed sharply since the spring and looks set to weaken further in the coming months as firms cut operating capacity in line with weakening demand.

“The flip side of deterioration in demand is a welcome alleviation of price pressures, which hint at a peaking of inflation.

The S&P Global US Composite PMI Output Index posted 47.7 in July, down from 52.3 in June to signal a renewed contraction in private sector business activity.

The decline in output was the first since June 2020 and broad-based.

[ad_2]

Source link