The fed is lying on inflation. Reality bites back.

Housekeeping: Thank you for the new subscribers. We hope you see GoldFix’s value.

Too Long/ Didn’t Read

Making friends with inflation, as the Fed did in July 2021 is about as smart as kissing “pet” turtles. More on that below. Thus, German inflation bit Powell on the face today (German PPI grew 5.3% MoM and 37.2% YoY in Jul, up from 32.7% YoY in Jun). This translates into more fears of global inflation, which implies the Fed may not be able to back off inflation-fighting as soon as the market hopes. What did that really mean?

- Obvious: inflation is inflationary

- Next Level: US leads in its own inflation prevention so what EU is dealing with is somewhat water under the US bridge. We’re fine.

- Top Level: Inflation is inflationary. Raise/crash/lower is the Fed path now

Either inflation normalizes at a significantly higher baseline, unemployment normalizes as being “full employment” closer to 5 or 6%, or we get a torrid stagflationary recession worse3 than the 1970s as the market resets itself on the backs of its citizens while leaders continue to delude themselves that all is well.

The Fed is Lying. No Way 2% Inflation Happens Without an Economic Crash

Authored by GoldFixSubstack

The Fed is lying. They might be lying to themselves. They might be lying to the public. We do not know. But we know one group they are definitely lying to: The politicians who control their current jobs. Why? Because politicians convey to economists all they care about is the next election. They also convey that the Fed members jobs depend on it. Hence, The Fed tells politicians what they want to hear. The US Fed has become a hero-worshiped entity, and it must be preserved for the “bigger picture”. At least until it gets rightly scapegoated and thrown under the bus eventually. The Fed’s power, like Wizard of Oz and Santa Claus; is a fiction to be preserved for now

Real or imagined, the Fed’s 2% target is not going to happen. It’s a Fairy tale. What is more, once they admit it (they can’t right now) stocks will explode blowing the cover on their goal of keeping asset prices down as incentive to get people to work again. It’s all a joke. More on this another time. But let’s put it this way: there are economic indicators the Fed cannot suppress telling you it’s all a lie created to obfuscate and placate. It is a house of cards being taken down in controlled demolition. Bu don’t believe us, Believe your favorite trillion dollar money manager who says the quiet part out loud:

“The Fed would, in order to get inflation down to the 2% target, have to crush the economy. In order to bolster growth, the Fed will at some point accept to live with inflation.” Ann-Katrin Petersen, BlackRock Source

To which Zerohedge added: “Yes, the Fed’s inflation “target” will be raised to 3%. That’s when everything goes limit up”. This is frighteningly accurate we fear. Which means: right now if you are long stocks you are hoping for higher tolerated inflation.. that’s how f*cked things are. But why would they capitulate?

Three Questions Keep it Real

Question 1: Can the Fed drive the real funds rate high enough and keep it there long enough (to kill inflation) while keeping unemployment under 5% ?

- Yes.if the govt employs 100million more IRS agents.

- No. Not yet. Powell is not Volcker in any way shape or form. He is Burns

- Given the political pressures of wealth redistribution via the “inclusive” mandate and current administration’s progressive pressures, there is almost no way the Fed has the political will or permission to do that.

- This can very likely end in a Nixon/Burns type of Fed diad where socioeconomic pressures, changing attitudes, Geo-political pressures and more conspire to make it impossible for the Fed to do this even if they wanted to.

- Probably not.Paraphrasing Zoltan from “Recession is Not an Option”: Especially not without goods inflation substantially down; which happens only without: war, sanctions, and East/West animosity.

- It is almost impossible to get inflation back down to an acceptable level without causing a worse GDP drop all the while keeping unemployment near its recent average

- Which all implies that they might crash the economy, and then reflate it even harder.

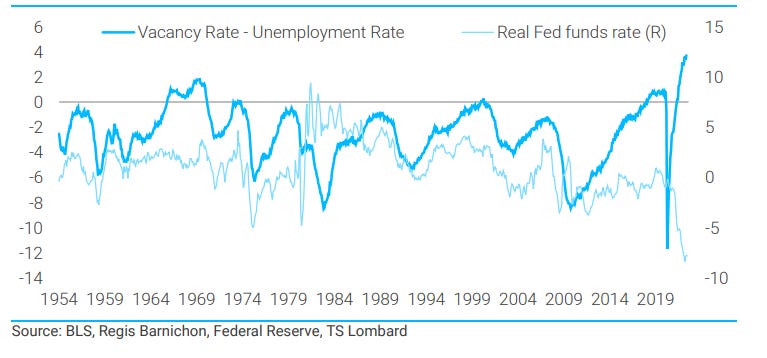

TS Lombard on the current predicament says higher normal inflation and/or unemployment needed to rebalance the economic table (emphasis ours):

The notion that inflation magically falls back to 2% without disrupting labour markets [ EDIT: or crashing GDP- VBL] is a fairy tale whose belief, when exercised in policy, translates into inflation during the [ next] recovery that follows the coming [current] recession that will be higher than what the economy experienced in the 2010-19 expansion. This is not a policy bias that ends well

Real Fed Funds Rate Must Follow Labor Demand or Sticky Inflation ensues…

Calculations and definitions will be changed, political pleading will commence, bureaucrats will be replaced, lectures will be given to “take our medicine”, tough love lectures, and all the knobs used to keep the economic data in an acceptable range will be twisted to make it seem ok.

But the real economy will get destroyed/reset by economic forces that cannot be massaged away like statistics can be. A generation of small business owners and working class families will see taxes go up while loopholes for the rich evolve and the poor need even more help than in the past.

2% inflation is a fantasy given these parameters. The noninflationary unemployment rate is now well above 3.5%. That relationship was broken through the use of QE. It was kept on life support from Goldilocks tailwinds and tactics like REPOs, RRP, YCC, Fed “guidance”, with Vol and Gold selling. But the jig is up.

Kiss the inflation Jerome…

Either inflation normalizes at a significantly higher baseline, unemployment normalizes as being “full employment” closer to 5 or 6%, or we get a torrid stagflationary recession worse than the 1970s as the market resets itself on the backs of its citizens while leaders continue to delude themselves that all is well.

There are almost no more knobs for the Fed to turn to reroute the economic flows; And no more safety valves to use for transitory restoration of fantastic economic expectations. One or more of the 3 legs that hold up our economic table has significantly reset.There is only one wildcard we see currently that voids this scenario, giving the Fed room to be right. That is if the Ukraine war ended and global trade resumed as it once was.

Inflation has to stabilize higher, unemployment must baseline above 5%, or GDP must go significantly lower (recession worse). Something has to give.

Lots more to read more here

Free Posts To Your Mailbox

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link