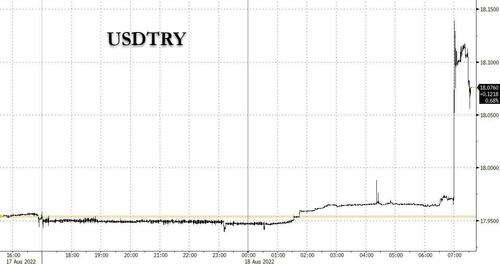

Lira Crashes After Turkish Central Bank Makes Shock Rate Cut Despite Raging Hyperinflation

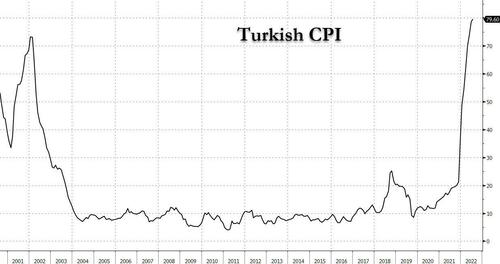

Nevermind the 80% inflation: the boss wants a rate cut and damn it, he will get a rate cut.

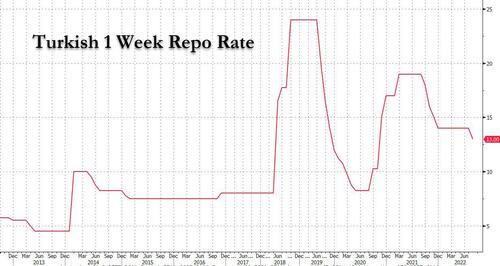

That’s probably what was swirling through the heads of the “dependent” Turkish central bank minutes before it shocked markets moments ago when – with the Turkish lira already at record low – it cut rates by 100bps from 14% to 13% with all 21 economists in the Bloomberg survey expecting an unchanged print.

The Monetary Policy Committee led by Erdogan puppet Sahap Kavcioglu lowered its benchmark to 13% on Thursday, after keeping it at 14% for the past seven months. And with the Turkish currency already at an all time low, it promptly plummeted another 1% lower against the dollar as it is now clear that Turkey has picked hyperinflation.

“It is important that financial conditions remain supportive to preserve the growth momentum in industrial production and the positive trend in employment in a period of increasing uncertainties regarding global growth as well as escalating geopolitical risk,” the MPC said in a statement. Here are some other highlights from the statement:

- Updated level of policy rate is adequate under the current outlook

- Leading indicators for 3Q point to some loss of momentum in economic activity

- It is important that financial conditions remain supportive to preserve the growth momentum in industrial production and the positive trend in employment in a period of increasing uncertainties regarding global growth as well as escalating geopolitical risk

- Stronger than expected contribution of tourism revenues to the current account balance continues

- Rate of credit growth and allocation of funds for real economic activity purposes are closely monitored

- Recent increase in spread between policy rate and the loan interest rate is considered to reduce the effectiveness of monetary transmission

- MPC decided to further strengthen the macroprudential policy set with tools supporting the effectiveness of the monetary transmission mechanism

- Comprehensive review of the policy framework continues with the aim of encouraging permanent and strengthened liraization in all policy tools of the CBRT

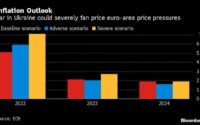

Kavcioglu has blamed a global rally in commodity prices, partly caused by Russia’s invasion of Ukraine in February. The central bank now expects inflation to reach a high of around 85% this fall, before ending the year near 60%, or 12 times its target.

As Bloomberg notes, the sudden resumption of monetary stimulus with less than a year before elections reflects the determination of Turkish authorities to follow through on authoritarian ruler Tayyip Erdogan’s promise in June that rate cuts will continue. The decision follows three weeks after the central bank revised this year’s inflation forecast higher by almost 18 percentage points.

Erdogan is intent on turbocharging growth by focusing on exports and employment as part of what he calls a “new economic model.” But risks abound as the cost-of-living crisis unfolding in Turkey poses a threat to his electoral popularity.

In place of higher rates, the central bank has rolled out “macroprudential measures” that helped slow loan growth momentum in July. It’s also relied on backdoor interventions and the introduction of state-backed accounts that shield savers from lira weakness.

The approach has allowed inflation to gallop near an annual 80% and left the lira vulnerable to a sell-off. The Turkish currency is among five of the world’s worst performers this year against the dollar, having lost around a quarter of its value.

Erdogan, long a believer that cheaper borrowing costs can slow inflation instead of pushing it higher, appointed Kavcioglu as governor of the central bank last year after ousting his three predecessors and seeking more sway over monetary policy.

An easing campaign by Turkey runs directly counter to what may prove to be the most aggressive tightening of monetary policy by central banks around the world since the 1980s.

And speaking of the lira, it of course plunged to a new all time low, the USDTRY soaring as high as 18.13, which is paradoxical since in the past month Turkey has been burning through all of its USD-denominated reserves to avoid a complete currency collapse… one which it just invited with its latest idiotic policy twist.

[ad_2]

Source link