US Services Sector Collapses In August, US Composite Weaker Than Europe

After the ugliness in Euro area PMIs, August’s flash PMIs for the US were expected to be mixed with Services improving and Manufacturing slowing – they were half right! US Services PMI collapsed in early August from 47.3 to 44.1 (well below the expected jump to 49.8). US Manufacturing also slowed more than expected, from 52.2 to 51.3 (below the 51.8 expectations)…

Source: Bloomberg

Services are at their lowest since May 2020 and Manufacturing at its lowest since July 2020.

At 51.3 in August, down from 52.2 in July, the S&P Global Flash US Manufacturing PMI continued to signal subdued operating conditions across the manufacturing sector. The headline reading fell to its lowest level in just

over two years, amid muted demand conditions and production cutbacks.

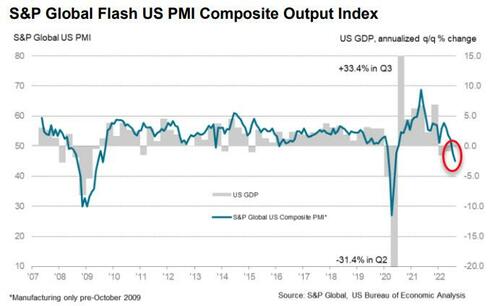

The US Composite PMI is the weakest of all the global regions…

Source: Bloomberg

Commenting on the flash PMI data, Siân Jones, Senior Economist at S&P Global Market Intelligence said:

“August flash PMI data signalled further disconcerting signs for the health of the US private sector. Demand conditions were dampened again, sparked by the impact of interest rate hikes and strong inflationary pressures on customer spending, which weighed on activity. Gathering clouds spread across the private sector as services new orders returned to contractionary territory, mirroring the subdued demand conditions seen at their manufacturing counterparts. Excluding the period between March and May 2020, the fall in total output was the steepest seen since the series began nearly 13 years ago.

“Lower new order inflows and continued efforts to rein in spending led to the slowest uptick in employment for almost a year. Reports of challenges finding suitable candidates started to be countered by those companies noting that voluntary leavers would not be replaced with any immediacy due to uncertainty regarding demand over the coming months.

“One area of reprieve for firms came in the form of a further softening in inflationary pressures. Input prices and output charges rose at the slowest rates for a yearand-a-half amid reports that some key component costs had fallen. Although pointing to an ongoing movement away from price peaks, increases in costs and charges remained historically robust. At the same time, delivery times lengthened at the slowest pace since October 2020, albeit still sharply, allowing more firms to work through backlogs.”

Finally, we note that the recent rampage higher in stocks – as cyclicals dominated defensives – appears to have been over done yet again…

Source: Bloomberg

Can Powell say anything to stop/slow the reversion of cyclicals to reality?

[ad_2]

Source link