Of Two Minds – The Fed Can’t Stop Supply-Side Inflation

August 22, 2022

The Fed and other central banks have zero control of supply-driven inflation, period.

America’s financial punditry is bewitched by four fatal fantasies:

1. Inflation is demand-driven. If the Federal Reserve (or other central banks) reduce demand with monetary tools

like raising interest rates, inflation will cool.

2. Substitution of high-cost goods with lower-cost goods reduces inflation, and substitution is infinite:

there’s always cheaper chicken if beef gets too pricey.

3. Higher prices will lead suppliers to increase production, which will increase supply and reduce prices.

4. The Federal Reserve has control of all these inflation-reducing dynamics via interest rates and its balance sheet

(buying or selling various durations of Treasury bonds).

All of these are fantasies, fantasies that are fatal because they’re flat-out false. The Fed has no control

over supply-driven inflation, which is what we have now. Consider eggs. The price has skyrocketed not

because consumers suddenly ramped up demand that is now outstripping supply, but because essential inputs

to supply such as feed and energy have soared in price and constraints that have nothing to do with interest rates

such as the spread of bird viruses.

These essential inputs are going up in cost due to factors completely unrelated to interest rates or monetary

policy. Drought and weather extremes are constraining the supply of animal feed stocks, and energy prices are

being driven by geopolitical forces completely outside central bank control.

Infinite substitution is also false. What’s the substitute for eggs? Silkworm goo squeezed into plastic eggs?

Well, not yet… there are no substitutes for eggs. And with the soaring input costs of producing chickens,

chicken is no longer that cheap.

Higher input costs affect all production. There are no cheaper substitutes when essential inputs for everything

are soaring due to supply constraints. The financial fantasy holds that entrepreneurs will rush to build

new production to reap the gains generated from higher prices, but this is nonsense when input costs are rising for

all producers.

Unless somebody can get nearly free energy and nearly-free feed, the new producer’s cost will be the same as

existing producers, whose profits are being pressured as prices rise. It makes no sense to pour capital into

a sector with declining profits and higher input costs.

The idea that raising ot lowering interest rates by 1% is going to magically resolve supply constraints

generated by systemically higher input costs is delusional on multiple levels. In the magical imagination

of our financial punditry, some fresh-faced entrepreneur will plant more grain to feed chickens because it’s so

darn profitable.

Nice, but what if there’s no water? What if the cost of fertilizer and other inputs is so high that

even higher prices might not yield a profit for such a risky venture? The disconnected-from-reality pundits

don’t factor in the possibility that one storm could wipe out the harvest just as the crop reaches maturity.

As for energy: there’s a 10-year permit process for whatever the fresh-faced entrepreneur has in mind.

Consider the much-hyped modular mini-reactors so many expect will solve all our energy problems. One

design just received the go-ahead, and a prototype is expected to reach the initial trials stage in…. 2030.

Yeehaw, that will solve our inflation right now, yowza.

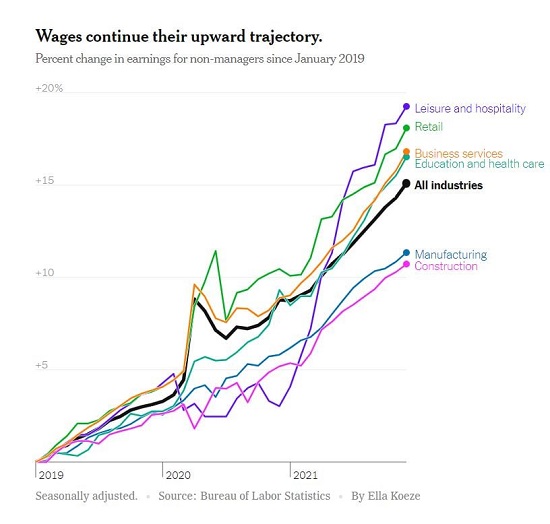

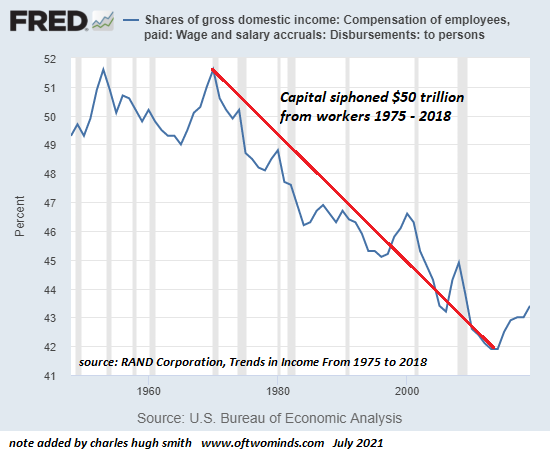

Meanwhile, back in the real economy the pundits don’t appear to inhabit, the Fed blithely oversaw the stripmining

of wage earners for 45 years and is now powerless to stop the inevitable snapback. Wages are rising

because workers need a living wage (Garsh, imagine that! Funny, that’s not in any of our statistical models).

The Fed increasing or decreasing its balance sheet by $1 trillion has zero effect on wages rising for

profoundly systemic reasons. And while we’re highlighting the Fed’s complete powerlessness over the

input constraints of essentials, let’s also burst the pundits’ delusional fantasy that the Fed raising or lowering

interest rates by a point or two has any effect on tax donkeys and debt-serfs whose student loans and

credit card balances remain at rapaciously high interest rates.

The fantasy that the Fed can reduce supply-driven inflation arising from systemic constraints on essential inputs

is not just delusional, it’s toxic because it generates unrealistic expectations and diverts policies

into dead-ends where real solutions become impossible because the assumptions being made are false.

The Fed and other central banks have zero control of supply-driven inflation, period. Trying to crush

inflation by crushing demand won’t fix inflation because the source is supply, not demand.

Note to Fed: hoping that we’ll love a gross-beyond-belief silkworm-goo substitute for eggs is remarkably

representative of your powerlessness and disconnect from reality.

Recent podcasts/videos:

Save Money On Food, Get Free Gold & Silver, Beat Price Inflation (1:08 hrs)

It’s Time To End The Fed & Return To A Decentralized Currency (X22 Report, 38 min)

Charles Hugh Smith On Inequalities And The Distortions Caused By Central Bank Policies (FRA Roundtable, 30 min)

Tectonic Shift of Mercantilism Revalued (Gordon Long, Macro-Analytics, 42 min)

My new book is now available at a 10% discount this month:

When You Can’t Go On: Burnout, Reckoning and Renewal.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My recent books:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 Kindle, $10 print, (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 Kindle, $8.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, John K.A. ($33.33), for your splendidly generous contribution |

Thank you, Craig W. ($20), for your marvelously generous contribution |

|

|

[ad_2]

Source link