Q2 GDP Revised Higher To -0.6%, As Price Index Soars To Highest Since March 1981

While few will care about the second revision to Q2 GDP which as of today ended nearly three months ago and all attention has shifted to the current quarter which concludes in a month, it was notable that for Q2, the BEA revised the GDP number which came in well above what it reported in its preliminary, first estimate and also what Wall Street expected, as the economy shrank “only” 0.6% in Q2, an improvement to the -0.9% reported initially and better than the -0.7% consensus expectation. Still, the data confirms that for all intents and purposes, the US remains in a technical recession.

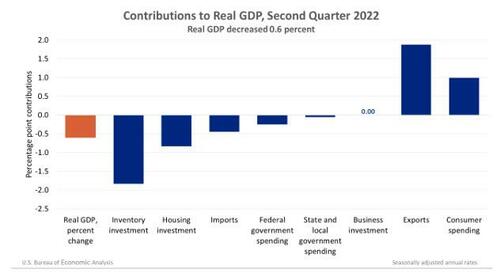

The second-quarter decrease in real GDP reflected decreases in inventory investment, housing investment, federal government spending, and state and local government spending. Exports and consumer spending increased. Imports, which are a subtraction in the calculation of GDP, increased.

Some more details:

- The decrease in inventory investment primarily reflected a decrease in retail trade (led by “other” general merchandise stores) and wholesale trade.

- The decrease in housing investment primarily reflected a decrease in brokers’ commissions.

- The decrease in federal government spending primarily reflected a decrease in nondefense spending

- The decrease in state and local government spending was led by a decrease in investment in structures that was partly offset by an increase in compensation of employees of state and local government.

- The increase in imports reflected an increase in services (led by travel).

- The increase in exports reflected increases in both goods (led by industrial supplies and materials) and services (led by travel).

- The increase in consumer spending reflected an increase in services (led by food services and accommodations as well as “other” services) that was partly offset by a decrease in goods (led by food and beverages)

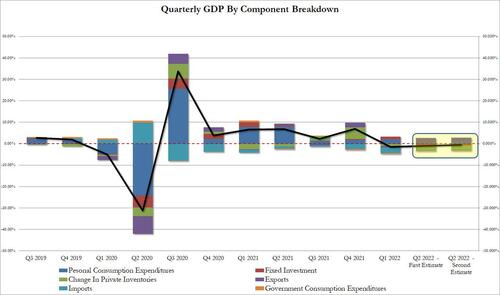

Compared to the initial GDP print, the revisions were as follows:

- Consumer Spending was boosted from 0.70% to 0.99% of the bottom line GDP print

- Fixed Investment on the other hand was revised modestly lower, from -0.72% to -0.84%

- The closely watched change in private inventories number ended up being revised higher, from -2.01% to -1.83%, which means that the inventory destocking likely has more to go in Q3, and is in fact bad news for the current quarter.

- Net exports (exports less imports) was unchanged at 1.43%, the same as the initial estimate.

- Finally, government consumption subtracted -0.32% from the final GDP print, essentially unchanged from the -0.33% reported one month ago.

And visually:

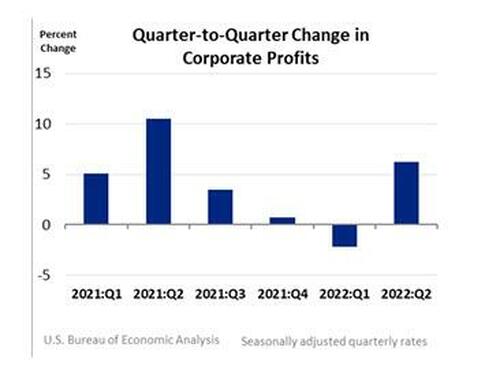

Separately, the report found that corporate profits had fallen 2.2% in prior quarter, while on a Y/Y basis, profits rose 8.1% in 2Q after rising 12.6% prior quarter. Financial industry profits declined 4.8% Q/q in 2Q after falling 9.3% prior quarter; Federal Reserve bank profits down 8.4% in 2Q after rising 11.1% prior quarter; Nonfinancial sector profits rose 9.4% Q/q in 2Q after falling 0.3% prior quarter.

And while none of the above could move the needle, what is notable is that inflation came in hotter than expected again, with Gross domestic purchases prices, rising 8.4% (revised) in the second quarter after increasing 8.0 percent in the first quarter. Excluding food and energy, prices increased 6.8 percent (revised) after increasing 6.9 percent. Personal consumption expenditure (PCE) prices increased 7.1 percent (revised) in the second quarter, the same rate as the first quarter. Excluding food and energy, the PCE “core” price index increased 4.4 percent (revised) after increasing 5.2 percent.

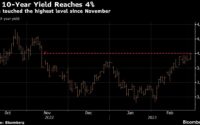

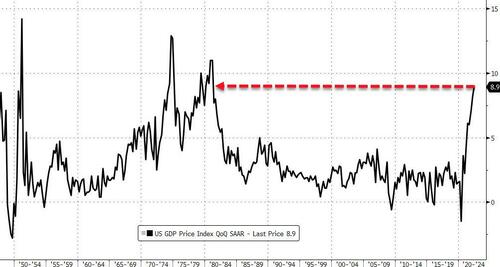

As for the reason why yields spiked and futures slumped after the GDP print, look no further than the deflator: the GDP Price Index, came in red hot at 8.9%, above the 8.7% expected which was also the number reported in the first revision.

Printing at a fresh 41 year high, it means Powell will see even more pressure to come off as hawkish.

[ad_2]

Source link