Fed’s Favorite Inflation Indicator Cools Modestly From 40-Year-Highs, Savings-Rate Hits 13-Year-Low

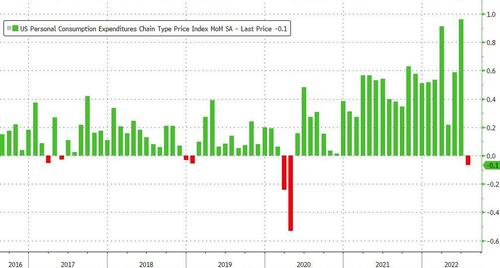

The Fed’s favorite inflation indicator – PCE Deflator – was expected to slow in July data and it did with the headline dropping from +6.8% YoY to +6.3% YoY (cooler than the +6.4% YoY expected). Core PCE also slowed from +4.8% YoY to +4.6% YoY (also below expectations)…

Source: Bloomberg

As a reminder, headline PCE remains very close to 40 year highs, though this is the first MoM drop in the headline PCE since the peak of the COVID lockdown crisis in April 2020…

Source: Bloomberg

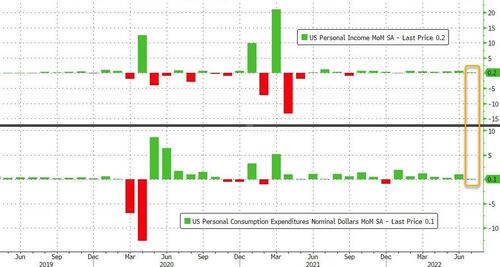

Americans’ personal income and spending (on a notional basis) were expected to rise in July and they did but missed expectations dramatically, rising just 0.2% MoM and 0.1% MoM respectively (vs +0.6% MoM and +0.5% MoM respectively). That is the weakest MoM growth in incomes since January and weakest spending since December…

Source: Bloomberg

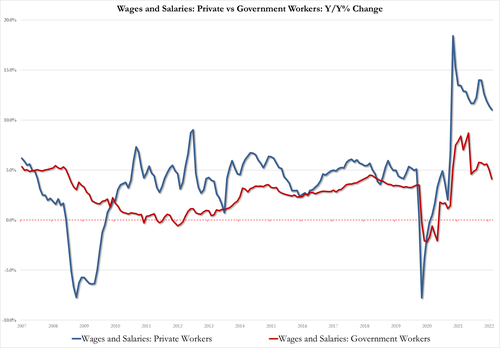

On the income side, both private sector and govt wage growth slowed in July:

-

Private worker wages up 11.0% Y/Y in July, down from 11.4% and lowest since March 2021

-

Govt worker wages up 4.1% Y/Y in July, down from 5.0% and lowest since March 2021

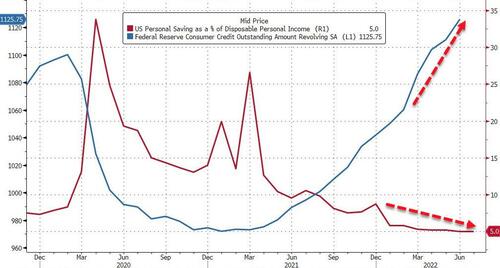

Finally, all of this means the savings rate fell further to 5.0% – the lowest since August 2009

Source: Bloomberg

And we suspect Powell’s messaging of further hikes and more pain to come will mean less saving and more credit card spending to cover the cost of living… and that doesn’t end well for anyone.

[ad_2]

Source link