Powell Warns Of “Economic Pain” From Tightening, Says “Historical Record Cautions Against Loosning Policy Prematurely”

You’re heard all the previews (here, here, here, and here), warning of disappointment.

You’ve listened to the under-card (Bostic, Bullard, and Harker all equanimously hawkish)

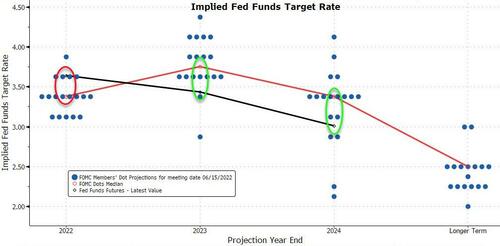

You’ve seen the decoupling between the market (tighter sooner then easier longer) and The Fed (tighter for longer, not easier for a while)…

Now it’s time for the main event…

As Mohamed El-Erian warned:

“I know what they should do, which is they should not blink…”

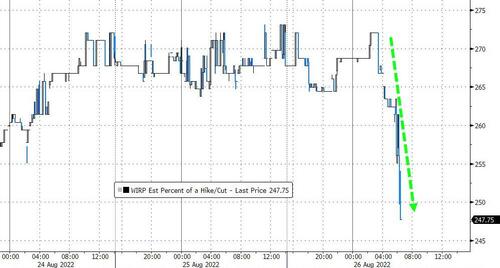

As a final point of reference, the market priced in a 48% chance of a 75bps hike in September right before Powell spoke…

Watch Fed Chair Jerome Powell deliver his Jackson Hole speech live (due to start at 1000ET):

And here is Powell’s speech, including highlights:

- Powell: Size of Sept. Rate Hike Hinges on ‘Totality’ of Data

- Powell: Will Likely Require Restrictive Policy for Some Time

- Powell: History Cautions Against ‘Prematurely’ Loosening Policy

- Powell: “inflation has just about everyone’s attention right now, which highlights a particular risk today: The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.”

Quoting from both Volcker and Greenspan, Powell lays out his speech in the form of three distinct lessons:

- The first lesson is that central banks can and should take responsibility for delivering low and stable inflation. It may seem strange now that central bankers and others once needed convincing on these two fronts, but as former Chairman Ben Bernanke has shown, both propositions were widely questioned during the Great Inflation period.

- The second lesson is that the public’s expectations about future inflation can play an important role in setting the path of inflation over time. Today, by many measures, longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency, with inflation having run well above our goal for some time. If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Unfortunately, the same is true of expectations of high and volatile inflation. During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decisionmaking of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions… Inflation has just about everyone’s attention right now, which highlights a particular risk today: The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.

- That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

The Fed Chair also had a very clear warning to the US: pain is coming:

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Putting it together, Powell concludes that “these lessons are guiding us as we use our tools to bring inflation down. We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.”

But just in case this is viewed as too hawkish, Powell also threw a bone to the doves:

“At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.”

A word cloud of Powell’s speech:

And the full speech (link here)

[ad_2]

Source link