The global economy may have entered a new era: “The Great Volatility”

As many of the world’s most powerful economic policymakers took to the lectern at an annual economic symposium in Jackson Hole, Wyoming, in the last few days, a recurring — and disturbing — theme emerged from the proceedings.

- Many of these leaders believe that the extraordinary economic volatility of the last few years — with whipsawing growth, supply disruptions and inflation — are likely to persist for many years to come.

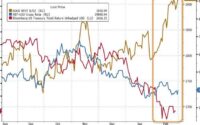

Why it matters: We may be entering a more inherently volatile period in the world economy. Geopolitics, pandemic, and climate change are the (mostly) steady growth and low inflation of recent decades a thing of the past.

- That would make the task of managing macroeconomic policy — tweaking interest rates, taxes and spending to keep the economy on an even keel — dramatically more difficult.

Driving the news: The headlines out of the Kansas City Fed’s annual symposium, which concluded Saturday, focused on Fed chair Jerome Powell’s Friday speech that presaged more interest rate increases to fight inflation.

- But there was a broader consensus of shifts in the fundamentals of the world economy evident at the gathering, where top global economic leaders convene each August to take stock and exchange ideas.

- Isabel Schnabel, a member of the European Central Bank executive board, called it the “Great Volatility” in a talk delivered Saturday. That contrasted with the “Great Moderation” of global growth and inflation from the 1980s to 2007.

State of play: Through the 2010s, the central economic challenge worldwide was inadequate demand: not enough spending, jobs or investment.

- So far in the 2020s, the predominant challenge has been one of inadequate supply.

- The pandemic created wide-scale rolling shutdowns of commerce around the globe.

- War in Europe is disrupting global energy and food markets, and the geopolitical outlook, including with China, is ominous.

- A warming climate and the more volatile weather patterns it fuels can also translate into supply shocks, as evidenced in recent weeks with factory shutdowns in China stemming from a heat-induced shortage of hydropower.

Just maybe, it has just been a run of bad luck. But when the bad luck seems to happen over and over, seems to be rooted in slow-m0ving forces and points in the same direction — namely, constricting global supply — it just might be a trend.

What they’re saying: “The challenges we are facing are likely to bring about larger, more frequent and more persistent shocks in the years ahead,” the ECB’s Schnabel said.

- “The global economy seems to be on the cusp of a historic change as many of the aggregate supply tailwinds that have kept a lid on inflation look set to turn into headwinds,” said Agustín Carstens, general manager of the Switzerland-based Bank for International Settlements, the central bank for central banks.

- “There is good reason for concern that the pandemic and war may lead to an era in which supply shocks are larger, and in which inflation expectations may be less well-anchored,” said Gita Gopinath, the No. 2 official at the International Monetary Fund, in a talk at the symposium.

Less certain, however, is how these economic policy technocrats ought to react to this more volatile world. Central bankers, after all, are not the ones who can make peace in Ukraine, fight pandemics or slow climate change.

- Rather, they have to take the world as it is and try to manipulate the dials to keep inflation from becoming permanently high while cushioning the economic pain of crises, where possible.

Reading the room: The overwhelming tone from speakers in Jackson Hole was one of monetary hawkishness. Starting with Powell’s speech Friday, there was an overarching sense that central banks must act to prevent a new norm of high inflation from setting in.

Yes, but: It’s also arguable that a more volatile supply and inflation will mean that central banks shouldn’t be too reactive to the latest supply challenge to emerge due to war, disease or climate events.

- Over the last generation, most of the world’s major central banks settled on the same goal: 2% annual inflation, give or take.

- It will be hard to achieve that if massive supply disruptions really have become more common, and trying might cause yet more economic pain. But nobody is exactly proposing a new approach — at least, at this point.

“If there are going to be many more of these meaningful shocks, you have to rethink what your monetary policy strategy will be,” Adam S. Posen, president of the Peterson Institute for International Economics and a former Bank of England official, tells Axios.

- “If you want to stick with an inflation targeting regime, you have to think about a higher or different kind of inflation target, or one that sections off some of these shocks,” he adds.

Central banks may be gun-shy about changing their approach to policy, in part because they did so just a couple of years ago. The new policy framework proved ill-suited for the inflationary pressures of the pandemic.

- “There’s a feeling of once burned, twice shy,” Posen says. “Nobody wants to announce a new strategy for a while.”

The bottom line: There is consensus that we have entered a more volatile era, with rolling supply disruptions likely to be the norm. There is less consensus in what economic policymakers should do about it.

[ad_2]

Source link