MarketsInsider/George Glover/8-29-2022

“Stock investors are placing too much weight on inflation and Federal Reserve monetary policy — and that’s ‘bizarre,’ given longer-term US bond yields are more important, a top Bank of America strategist has said.”

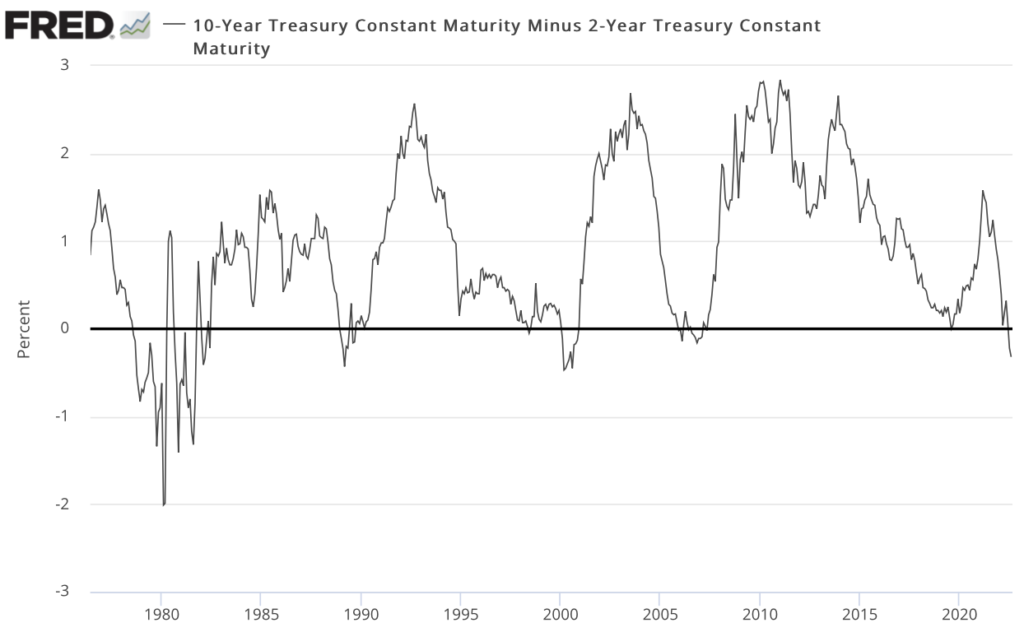

USAGOLD note: There will be new bond concerns as we move into September, and the Fed’s withdrawal from the market as a buyer becomes more of a direct factor in pricing. The strategist mentioned – Savita Subramanian – sees the yield curve as more critical than Fed jawboning. “This is a very complex moment for equities,” she asserts. From a historical perspective, it might be helpful to note that the ten-year-two-year yield curve has not been this inverted since 2000 (just before the launch of gold’s secular bull market) and before that in 1980 (the peak of the 1970s stagflation).

Source: St. Louis Federal Reserve [FRED]