GLOBAL MARKETS-Shares tumble, yields jump as data fuel rate angst

* European stocks, U.S. stocks drop after US job openings, German inflation data

* Government bond yields spike on rate hike bets

* Markets brace for further hawkish Fed, ECB action

* Oil tumbles 4% on fears of economic slowdown (Updates prices)

By Lawrence White and Koh Gui Qing

NEW YORK/LONDON, Aug 30 (Reuters) – World stocks tumbled again on Tuesday amid concerns about the chance of more interest rate hikes in Europe and the United States, after data showed economic growth and inflation have stayed resilient in both regions despite the policy tightening so far.

Two-year U.S. Treasuries scaled a new high not seen since 2007 after data showed on Tuesday that U.S. job openings increased in July, showing no signs that demand for labor was slowing, thereby bolstering the case for the Federal Reserve to stick to its aggressive monetary policy tightening path.

Data also showed German inflation rose to its highest level in almost 50 years in August, beating a high set only three months earlier, and strengthening the case for the European Central Bank to go for a larger rate hike next month.

The U.S. S&P 500 index quickly gave up early gains to fall 1.1%, the Dow Jones Industrial Average lost 0.9%, and the Nasdaq Composite dropped 1.25%.

The pan-European STOXX index also gave up earlier gains to be down 0.7%, and MSCI’s world equity index fell 0.8%.

The two-year Treasury yield climbed to a new high of 3.4970%, its highest since late 2007, and well above benchmark 10-year yields, which also rose, but only to 3.1324%.

Germany’s 10-year yield rose to 1.53%, close to the two-month high reached on Monday of 1.548%. Euro zone government bond yields had fallen earlier as markets calmed following dramatic action on Monday when European Central Bank board member Isabel Schnabel ‘s warning about rising inflation sent bond yields spiking up 12 to 20 basis points.

Global markets are extremely sensitive to such hawkish comments from key policymakers at the moment, as they hope for a pivot to looser policies that might mitigate the euro area’s grim economic outlook.

Investors fear that policymakers’ battle to contain rising prices worldwide with rate hikes could risk exacerbating economic pain, and push economies into recessions.

“One thing is clear: a recession in Europe looks all but inevitable, and the only question is how long and how severe it will be,” Frederik Ducrozet and Axel Roserens of Pictet Wealth Management wrote on Tuesday.

FORCEFUL ACTION

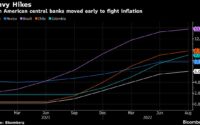

At the Jackson Hole conference, the Fed’s Powell and ECB speakers flagged the need for forceful action to tackle inflation, driving selling of bonds and equities as traders jacked up near-term interest rate expectations.

“Investors looking for market salvation from a Fed pivot didn’t get it at the Fed’s travelling show in Jackson Hole,” said Jason Darho, head of asset allocation for the Americas at UBS Global Wealth Management.

“Instead, investors should expect the market regime of high volatility and range-bound trading to persist for a while longer.”

Futures markets have odds of better than two-thirds that the ECB raises rates by 75 basis points in September, and see about a 70% chance that the Fed does likewise.

U.S. non-farm payrolls data are due on Friday, and markets may not like a strong number if it supports the basis for a continuation of aggressive rate hikes.

The prospect of more U.S. rate hikes pushed the U.S. dollar up 0.4% to 109.060, not far from the two decade peak of 109.48 it made a day earlier, while the euro slipped further below parity to 0.99840.

Rodrigo Catril, a strategist at National Australia Bank, said the euro would be tested by the upcoming inflation numbers in the eurozone, jobs data in the United States and Russian cuts to gas flows later in the week.

“The European story is actually all about the economic outlook… No energy means no growth,” he said, adding it would not be a surprise if the euro fell back to $0.96.

Oil prices tumbled on fears that an inflation-induced weakening of global economies would soften fuel demand, and as Iraqi crude exports have been unaffected by clashes there.

Brent crude futures for October settlement fell 4.6% to $100.28 a barrel, after climbing 4.1% on Monday, the biggest increase in more than a month.

Gold prices fell slightly as the precious metal continued to wilt in the face of the strong dollar, with spot gold last traded at $1,721.4200 per ounce.

(Additional reporting by Xie Yu, Editing by Stephen Coates, Gareth Jones and Tomasz Janowski)

[ad_2]

Source link