Capitulation Is Coming | ZeroHedge

Submitted by QTR’s Fringe Finance

The ethos in stock market trading on Monday was all too familiar: it reminded me of every trading day over the last 10 years. The market had a legitimate reason to plunge – a continuation of Friday’s selloff which, in my opinion, was for a very good reason – but instead the market rallied on the open and pared its losses by the close.

“Three things cannot be long hidden: the sun, the moon, and the truth.”

Of all the things that bulls have going for them, one of the most powerful is the perpetual tailwind of psychological buy-in to the narrative that stocks are always going to move higher. Not unlike the jet stream helping an airplane along a cross-country flight, this psychological buy-in has been an uninterrupted undercurrent in capital markets in this country for a century.

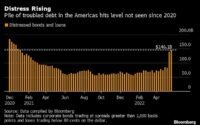

Ergo, as the above chart shows, there have been very few bumps in the road that have been able to shake this unwavering mentality. Even giant market disruptions, like the one we saw after people finally realized Covid was going to be a big deal, eventually find a way to smooth out and continue moving in one direction: up.

All this “smoothing out” of late has occurred regardless of valuation, common sense, geopolitical events or monetary. Yet I still believe last week’s speech by Jerome Powell at Jackson Hole all but guarantees another massive shockwave coming for markets. Hell, Powell said twice within the last two paragraphs of his speech that the Fed needed to stay at it until the job was done:

That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

These lessons are guiding us as we use our tools to bring inflation down. We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

“You’re not goin’ anywhere ya think lump! Ya still until the job’s done!”

Since then, even the most dovish members of the FOMC…(READ THIS FULL ARTICLE HERE).

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link