Weak Euro, Not Strong Dollar

Taps Coogan – August 27th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

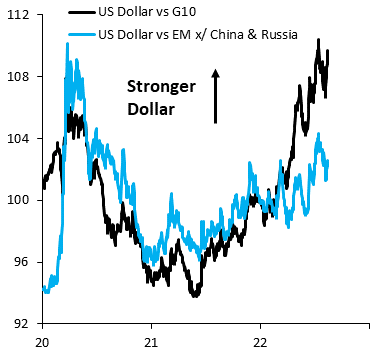

The following chart, from Robin Brooks, highlights an important distinction vis-a-vis the US dollar. The rise in the ‘Dollar Index’ over the past couple years is better thought of as weakness in the Euro than true strength in the Dollar.

The Dollar Index that is so frequently used to refer to the ‘strength’ of the dollar is a basket of the Euro (56.7%), the Japanese Yen (13.6%), the Pound Sterling (11.9%), the Canadian Dollar (9.1%), the Swedish Krona (4.2%), and the Swiss Franc (3.6%).

Over half of the Dollar Index is the just the Dollar/Euro exchange rate and 76.4% is European currencies.

In 2022, that is an absurd basket to measure the dollar against. You’ll find no justification for those weightings in trade patterns, currency markets, economics, etc… Europe is about 20% of the global economy and less than 40% of US forex trading.

Where is the Mexican Peso, the Brazilian Real, the Korean Won, the Hong Kong Dollar, the Indian Rupee, etc…? (You can’t include the Chinese Yuan because it’s pegged to a basket dominated by the dollar).

As the chart above highlights, while the US dollar has done historically well versus the Euro in the past couple years, gains against emerging markets have been more muted. A large portion of the rise the Dollar Index can be ascribed to weakness in Europe.

Weakness in the Europe should surprise nobody. In addition to having the several of the highest taxed countries in the world, an anti-growth regulatory regime, a shrinking population, and an acute energy crisis owing to years of terrible decision making, the Eurozone is still flirting with zero-interest rate policy and QE despite nearly 9% inflation.

It’s long past time to replace the Dollar Index with a basket weighted by trade or forex transactions.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

[ad_2]

Source link