Financial Times/Gillian Tett/9-8-2022

“However, investors should keep an eye on another item on the agenda: their approach to energy derivatives markets, clearing houses and exchanges. This might seem arcane but the issues now bubbling in the derivatives sphere represent another potential time bomb for Europe — one that needs to be urgently addressed.”

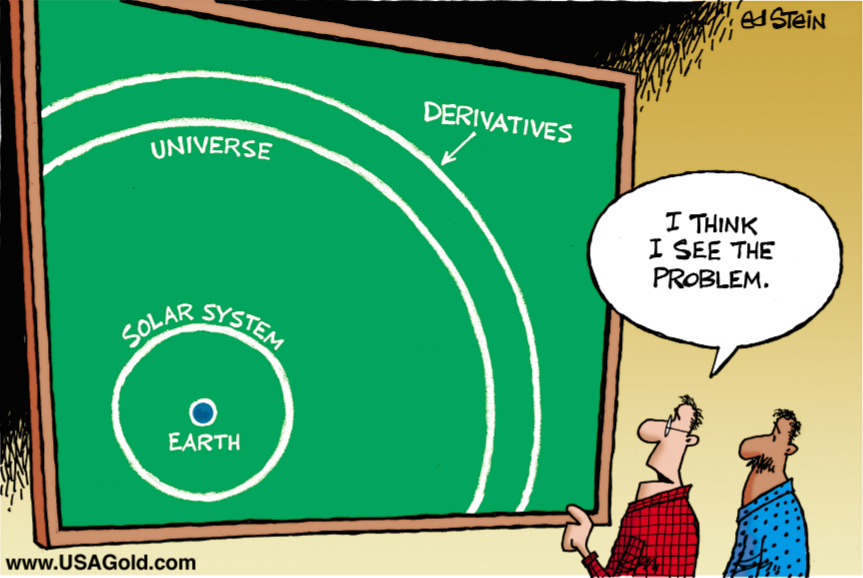

USAGOLD note: More detail on Europe’s €1.5 trillion energy margin call. Utility companies do not have the capital to meet the call, says Tett, and governments have failed to prepare the accompanying shock. She calls it the “€1.5 trillion derivatives time bomb.” As we have noted previously, it is odd that European financial markets have not registered a deeper, more visceral concern about the problem which is unlikely to simply disappear.