Goldman Says Fed May Slam S&P As Low As 2,900

Less than a year ago, Goldman (or at least its client-facing sellside research team) was one the most bullish banks on Wall Street, with chief US equity strategist putting a 5,100 S&P price target for his 2023 year end forecast last November. That, to put it mildly, has been a complete disaster of a forecast, and in subsequent months, Kostin has repeatedly slashed his S&P target, and most recently the house “base case” is for a far more modest 4,300, and quietly predicting that in a recession – which is definitely not Goldman’s base case yet – the S&P would fall as low as 3,150.

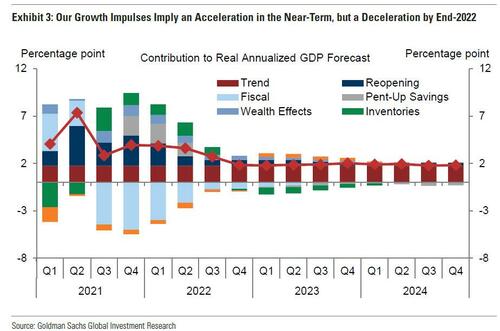

Of course, it’s just a matter of time before Goldman does make a recession its base case – it hinted at just that over the weekend when it cut its US GDP forecast, now seeing 0% growth for the US economy which it expects to stagnate in 2022.

[ad_2]

Source link