Bloomberg/John Authers/9-23-2022

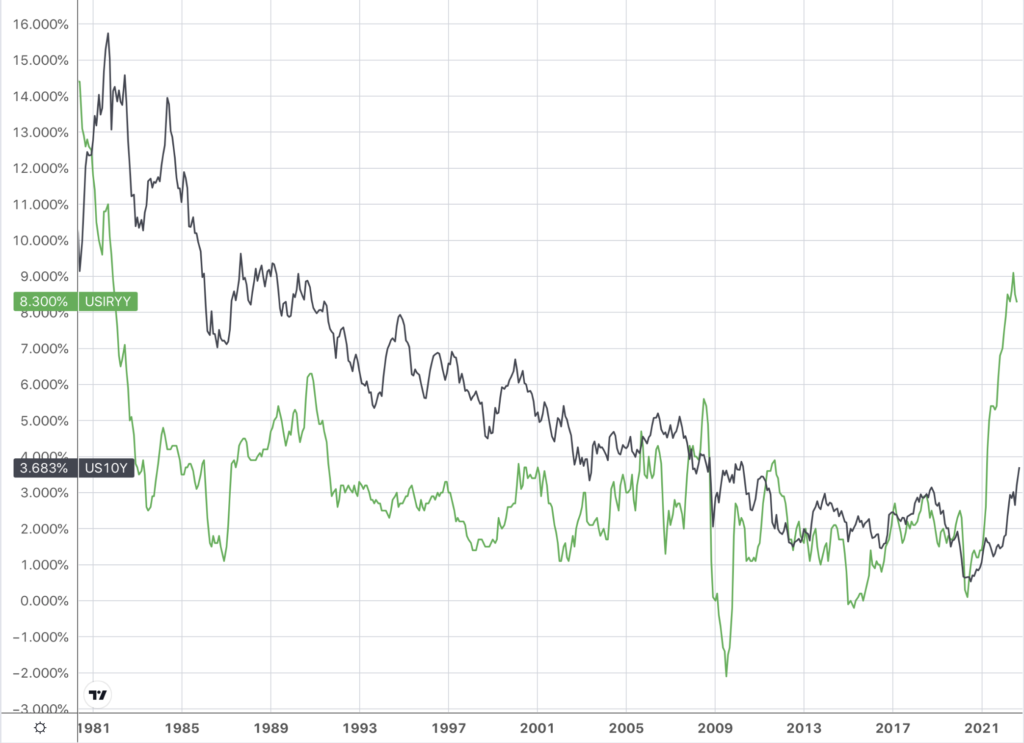

Yield on the 10-Year Treasury note and headline inflation

(%, 1980-present)

Chart courtesy of TradingView.com

“We’re living through arguably the most truly global attempt to tighten financial conditions in memory. This is shifting the tectonic plates beneath the world economy, and threatens dangerous developments in society and in politics as we all try to adapt. And yet what strikes the eye after a week of market landmarks and aggressive interventions by central banks is the continuing discord.”

USAGOLD note: With thata as the intro, Authers goes on to offer a top-drawer assessment of what the new age of rising rates means for investors. “The rules that most people now active in markets have learned to live by no longer apply.” Authers says the rule of thumb is that the fed funds rate must get above the inflation rate for policy to be “meaningfully restrictive.” If so, he says, “this episode has a long way to run” – a view not too distant from our own. As the chart above shows, and Authers goes to pains to point out, we have a clean break with the past on two scores – the first in the long term trend in falling rates, the second in the real rate of return on the 10-year Treasury.

USAGOLD note: With thata as the intro, Authers goes on to offer a top-drawer assessment of what the new age of rising rates means for investors. “The rules that most people now active in markets have learned to live by no longer apply.” Authers says the rule of thumb is that the fed funds rate must get above the inflation rate for policy to be “meaningfully restrictive.” If so, he says, “this episode has a long way to run” – a view not too distant from our own. As the chart above shows, and Authers goes to pains to point out, we have a clean break with the past on two scores – the first in the long term trend in falling rates, the second in the real rate of return on the 10-year Treasury.