Investment Research Dynamics/9-26-2022

“Something stopped the selling of paper gold and silver back then – some trigger event – and the paper shorts scrambled to start covering, driving the market higher and setting off a 2 1/2 year bull move in the precious metals sector. Whatever that catalyst was – and it was connected to the de facto credit market/banking system collapse – will be triggered again. It’s a matter of timing.”

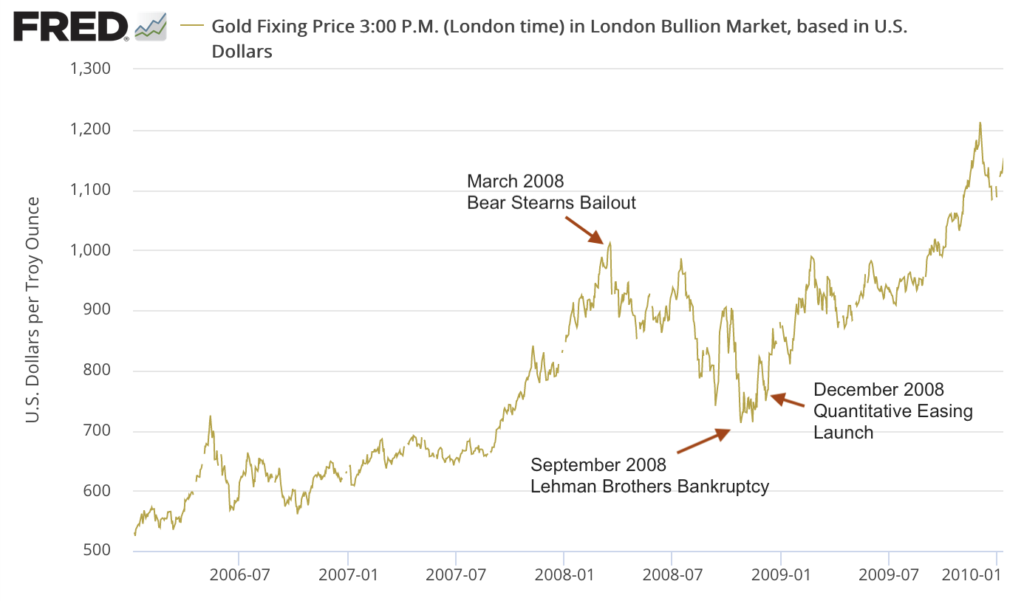

USAGOLD note: Kranzler makes reference to the “bifurcated” structure of the gold market – paper gold vs. physical gold. As a result of the low pricing generated in the paper market, he says, there has been a large flow of cheap gold and silver to buyers in the Eastern hemisphere. Now, he cautions, “the set-up in the markets is startlingly similar to that of late September and early October 2008.” He predicts a similar trigger event to occur possibly before Christmas.

Gold price and major market events of 2008

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration, London Bullion Marketing Association

Annotations by USAGOLD