MarketWatch/Mark Hulbert/10-1-2022

“A recent Howard Marks essay provides one of the best bill of particulars I’ve ever read for why we should be skeptical of macro predictions, and I urge you to read it in its entirety. Marks is the founder of Oaktree Capital Management; his periodic commentaries, known as memos, are widely read on Wall Street. Warren Buffett, for example, once said that ‘when I see memos from Howard Marks in my mail, they’re the first thing I open and read. I always learn something.’”

USAGOLD note 1: We featured Howard Marks’ thinking on macro forecasting in the August edition of News & Views under the headline: Dare to be different – Choose assets that ‘others haven’t flocked to and caused to be fully valued’. Marks has garnered considerable attention for his views particularly in light of the Fed’s seeming inability to get things right when it comes to forecasting problems like inflation or unemployment. That shortcoming, as Marks points out, extends to predicting how various investments are likely to perform over extended periods of time particularly when they are based on assumptions that might be off-base in the first place.

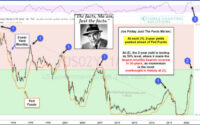

USAGOLD note 2: In our view, that is about as strong an argument for diversification as one could make – and by that we mean real diversification outside the realm of dollar-denominated assets, i.e., gold and/or silver. Says Marks, “If you seek superior investment results, you have to invest in things that others haven’t flocked to and caused to be fully valued. In other words, you have to do something different.”

The September 2022 edition of Marks’ newsletter: The Illusion of Knowledge