BofA Warns Of ‘Bear Stearns Moment’ If Central Bank Put Fails

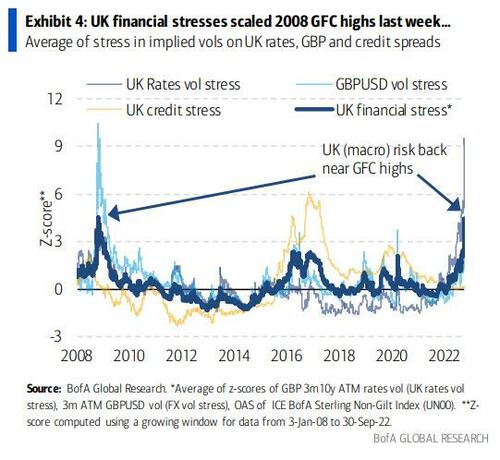

Last week’s UK crisis was a reminder of how dependent markets are on central bank support, and the dilemma they face in maintaining market stability in the face of furious inflation.

As BofA writes in a note this morning, not since Greenspan invented the central bank put in the ’87 crash have they been this constrained and we see the biggest visible tail-risk as a test & fail of the Fed put.

Crucially the bank points out that the UK events also highlight that even when a risk is well-telegraphed (global tightening), markets remain full of hidden risks.

Specifically, BofA draws five lessons from last week’s UK crisis, as it corroborated several concerns and made clear the risks emerging from today’s policy and market environment:

1. Painful withdrawal: A highly-levered system “addicted to doves” is being rudely awakened by the fastest, most aggressive monetary policy tightening in over 40yrs, and wide cracks are emerging.

2. Hidden risks: Even when the main risk facing markets is visible and relatively slow-moving (as CB tightening has been this year), markets are full of hidden risks and non-linearities that only reveal themselves in times of stress. We’ve been partly attributing the complacency in equity vol this year to the well-telegraphed nature of the catalyst. But this episode should remind equity investors of the existence of “unknown unknown” secondary effects (at times coming from abroad) and force them to price in a thicker left tail in stocks. We have indeed seen a notable jump in some equity vol risk premia following last week’s events, primarily in Europe but also in the US to a lesser degree.

3. Testing the Central Bank put: The trade-off between fighting inflation and maintaining financial stability is a complication for central banks not faced in 35 years since the central bank put was invented. The BoE had to pause their inflation fight last week to restore financial stability, and the Fed could be close to having to do the same, as we argued previously (plus, our rates strategists say risks of a breakdown of Treasury market functioning are growing).

4. Relief only temporary: The BoE’s intervention prevented a real catastrophe for UK assets. But the emergency policy response didn’t fix the underlying problem, namely the highest rates of inflation in decades. In fact, the BoE’s actions in the Gilt market are counter to their stated inflation-fighting plan, and each test of the central bank put may see less and less of a calming impact on markets. If the BoE put were to fail (or the next test of a central bank put), the risk is that it’s akin to the Bear Stearns moment of the 2008 crisis, causing investors to further question central banks’ ability to provide protection in the era of high inflation. The Fed facing a similar dilemma and failing would be the Lehman moment.

5. Dented Central Bank credibility: In fact, even the relief rally after the BoE intervention was underwhelming compared to other central bank rescues post-GFC. The S&P 500 hit new YTD lows several times in that same week, as did the local FTSE 100. To us, this is a sign that central bank credibility is already dented, and strengthens our view that the biggest risk to markets is a test & fail of the Fed put.

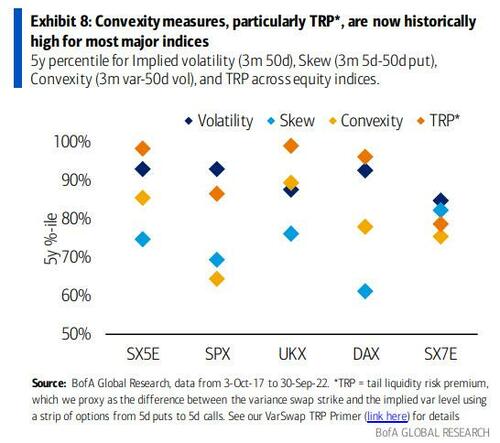

Reflecting on these lessons, BofA warns that historic moves in Gilts and Sterling akin to those seen last week have the ability to cause further contagion and add further pressure on central banks that are already constrained by persistent inflation. The path to contagion, though not the base case, can be rapid. Indeed, the recent re-pricing of derivatives convexity serves as a reminder that tail risks aren’t dead and the bank continues to recommend investors concerned about risk combine hedges for a grind lower with more convex protection.

The next test of the CB put (in the UK or elsewhere) may not be so easy to remedy without the ability to do “whatever it takes” for as long as it takes.

And if the BoE put were to still fail (they are not out of the woods yet), the risk is that it’s akin to the Bear Stearns moment of the 2008 crisis. The Fed facing a similar crisis would be the Lehman moment in our view.

Timing this risk is hard and oversold markets could create another June like bear-rally. Between Bear and Lehman, the S&P rallied 10% before selling off.

But any risk-rally is also a good time to enter hedges, and we continue to suggest smart grind-lower coupled with cheap to carry convexity hedges.

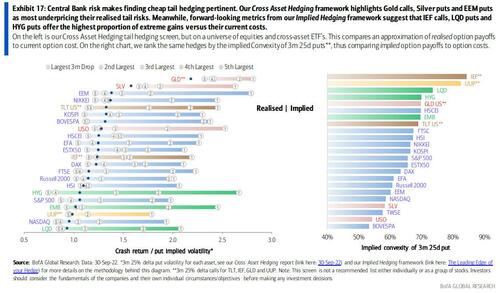

Interestingly, BofA sees ‘Gold Calls’ as ranking cheapest versus their potential realized tail risks.

Additionally, BofA sees IEF calls, LQD puts and HYG puts as screening best as hedges, offering the highest proportion of extreme gains vs current costs.

As BofA notes, its far from all-clear with respect to UK risk, and if last week was any guide, we are watchful of further contagion to financial assets outside the UK.

So maybe those ‘Gold calls’ make sense here.

[ad_2]

Source link