The World Hates the Fed

Inflation ticks back up … the Fed shows no sign of dovishness … Wall Street still doesn’t buy it 100% … the Fed is destroying the global economy … what to watch next

On Friday, the Fed’s preferred inflation gauge came in hot, raising a few eyebrows about the level of the upcoming Consumer Price Index.

August’s Personal Consumption Expenditures Price Index excluding food and energy rose 0.6% after being flat in July.

Here’s CNBC with the details:

[The 0.6% reading] was faster than the 0.5% Dow Jones estimate and another indication that inflation is broadening.

On a year-over-year basis, core PCE increased 4.9%, more than the 4.7% estimate and up from 4.7% the previous month.

Including gas and energy, headline PCE increased 0.3% in August, compared with a decline of 0.1% in July.

It rose even with a sharp decline in gas prices that took the cost at the pump well below the nominal record above $5 a gallon earlier in the summer.

Wall Street is already terrified the Fed will tighten too much, eventually breaking something – this news doesn’t ease those fears.

After all, to a “data dependent” Fed, this above-forecast inflation reading just reinforces Federal Reserve Chairman Jerome Powell’s hawkish bottom-line from his September FOMC press conference:

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

…Inflation has not really come down.

None of the Fed presidents are showing any sign of breaking dovish either

Here’s Federal Reserve Vice Chair Lael Brainard on Friday:

Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target. For these reasons, we are committed to avoiding pulling back prematurely.

Inflation is very high in the United States and abroad, and the risk of additional inflationary shocks cannot be ruled out.

Last Thursday, St. Louis Fed President James Bullard spoke directly to Wall Street, basically saying “congrats, you’re finally getting the picture!”

From Bullard:

If you look at the dots, it does look like the committee is expecting a fair amount of additional moves this year.

I think that that was digested by markets and does seem to be the right interpretation.

Despite this comment from Bullard, Wall Street doesn’t appear convinced.

To illustrate, a moment ago, we highlighted Lael Brainard saying monetary policy needs to hit restrictive levels.

So, what is that level?

Here’s Powell from his post-FOMC press conference:

Restoring price stability will likely require maintaining a restrictive policy stance for some time…

As shown in the SEP, the median projection for the appropriate level of the federal funds rate is 4.4 percent at the end of this year.

Now, a question…

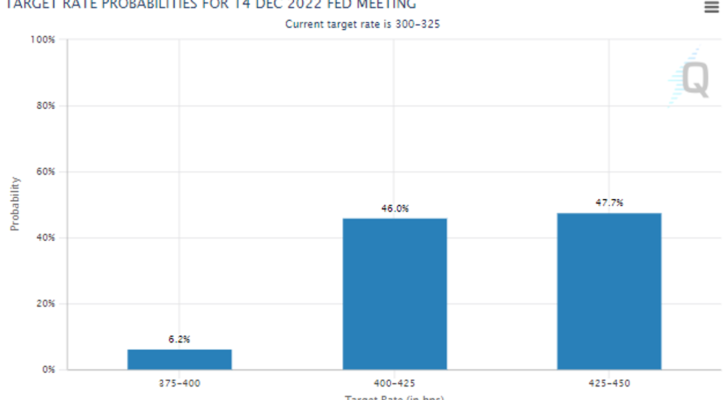

If Wall Street was finally getting “the right interpretation,” as Bullard put it, wouldn’t Wall Street estimate that the target fed funds rates in December will be 4.25% – 4.50%?

After all, that target range covers the median 4.4% level that Powell explicitly referenced.

Well, while 47.7% of traders do believe this, a whopping 46.0% believe the Fed will undershoot this level and come in at 4.0% to 4.25%. Plus, more than 6% of traders expect the rate will be just 3.75% to 4.0%.

Here’s how this looks, courtesy of the CME Group’s FedWatch Tool.

Source: CME Group

Wall Street just won’t take Jay Powell at his word.

It’s understandable since his word carries the stain of “transitory inflation.” But still – such willful disbelief sets up stocks for more downward pressure if/when Powell & Co. are true to their word, and it “surprises” Wall Street.

There’s one revelation, however, that can no longer be considered a “surprise” if and when it happens: The Fed’s acceptance of a recession as tolerable collateral damage in the war against inflation. Cleveland Fed chief Loretta Mester let that cat out of the bag last week.

From Bloomberg:

“Real interest rates — judged by the expectations over the next year of inflation — have to be in positive territory and held there for a time,” she said earlier in an interview on CNBC. “We’re still not even in restricted territory on the funds rate.”

Asked in a later panel discussion if a US recession would stay her hand in terms of raising interest rates, Mester said: “We’re going to do what we have to do to get the price stability. So — no.”

Say goodbye to any final, lingering heartbeats in the “Fed put.”

Meanwhile, buckle up if you’re a foreign central bank

The Fed is not winning any global friends these days.

That’s because its tightening policy is acting like a wrecking ball, inflicting massive damage on foreign economies and currencies.

As the Fed continues raising rates, this strengthens the dollar, adding to the inflation woes of other countries.

For example, in the Digest last week, we discussed the situation in Japan. The Japanese government has had to step in to shore up the value of its imploding currency, in large part thanks to the strength of the dollar.

We also covered the debacle in Britain, in which the Bank of England had to step in to buy long-dated gilts (bonds) to prevent a credit crisis meltdown.

To be fair, the cause of this can’t be placed exclusively at the feet of the strong dollar. But the strong dollar has played a huge role in the weakening of the pound, which is a key factor in the drama.

Then last Friday, we learned that eurozone inflation hit a record 10%. Again, we can’t lay exclusive blame for this on the dollar. Europe’s spiraling energy situation plays a massive role. But here too, the strong dollar is a significant inflationary influence.

In all of these situations, the Fed’s actions are contributing to an unwinnable position for global central banks…

Due to surging inflation and dollar strength, foreign central banks must hike interest rates. But doing so will act as a noose around the neck to their respective economies, resulting in stagflation.

In the midst of this, don’t expect an about-face from the Fed.

From the Financial Times’ recent piece titled “A global backlash is brewing against the Fed”:

The consequences of the Fed’s mistakes are effectively exported from the US, burdening America’s trade partners…

When asked about the global repercussions of the Fed’s actions [two Wednesday’s ago], chair Jay Powell flagged that he, while aware of what was going on elsewhere, had a mandate to lower domestic inflation and protect domestic jobs.

Translation: shrug.

Here’s how Mark Sobel, a former top Treasury career official who now is the U.S. chairman of the Official Monetary and Financial Institutions Forum puts it:

Treasury may well fear that the dollar’s strength will set the stage for complaints from abroad and protectionist pressures in the U.S. down the road, but for the near term their best strategy is to try and keep their mouths shut.

And so, the Fed continues to destabilize the global economy, greatly increasing the odds of a global recession that hits many countries simultaneously.

I’m not suggesting the Fed has a better course of action today. It’s just unfortunate that we’re in this spot at all when we didn’t need to be.

The damage that the Fed is inflicting internationally will eventually come full circle, with you and me footing the bill

As we’ve noted many times here in the Digest, roughly 50% of the S&P’s revenues come from international sales.

So, as the Fed hikes rates… which strengthens the dollar… which exacerbates global inflation… which results in currency-exchange and consumer-demand headwinds for U.S. multinationals… then corporate earnings here in the U.S. take a big hit.

Now, we could stop there and tie reduced earnings to the impact on your portfolio. But the butterfly effect is wider.

When earnings fall enough, bottom-line-oriented executives layoff workers (the latest of which is Meta, which has now frozen new hires and is hinting at layoffs to come) …

And when enough companies cut staff, we get a full-blown recession.

Legendary trader Stan Druckenmiller sounded the alarm on this last week, saying:

We are in deep trouble…

I will be stunned if we don’t have a recession in ‘23. I don’t know the timing but certainly by the end of ‘23.

I will not be surprised if it’s not larger than the so-called average garden variety. I don’t rule out something really bad.

Coming full circle, today’s Digest opened with news about last Friday’s hotter-than-expected personal consumption expenditures price index reading. Let’s cross fingers that the CPI release a week from Thursday does not follow suit, and instead, shows major cooling.

That’s how we back away from the brink. That’s how we stop this domino effect.

If the data don’t improve, then the Fed will indeed break something. The only questions then will be “where in world will these breaks take place?” and “how bad will they be?”

All eyes on next Thursday.

Have a good evening,

Jeff Remsburg

The post The World Hates the Fed appeared first on InvestorPlace.

[ad_2]

Source link