The US real estate sector braced for cuts as rising interest rates crush home sales – texttospeech

Realtors, mortgage brokers and appraisers across the U.S. are bracing for major cutbacks as home sales plummet amid rising interest rates.

For those who work in and around the housing market, the effect of aggressive measures is off Federal Reserve reducing inflation has been swift and severe.

“It went from feast to famine, from everybody bought to turtle slowly,” said Linda McCoy, president of the National Association of Mortgage Brokers.

Real estate agents, mortgage brokers, appraisers and construction companies say they have lost as much as 80 percent of their revenue since the Fed began raising rates in March. Prices for a 30-year fixed mortgage – at 6.66 percent – have almost doubled since then and are now at their highest level since 2008.

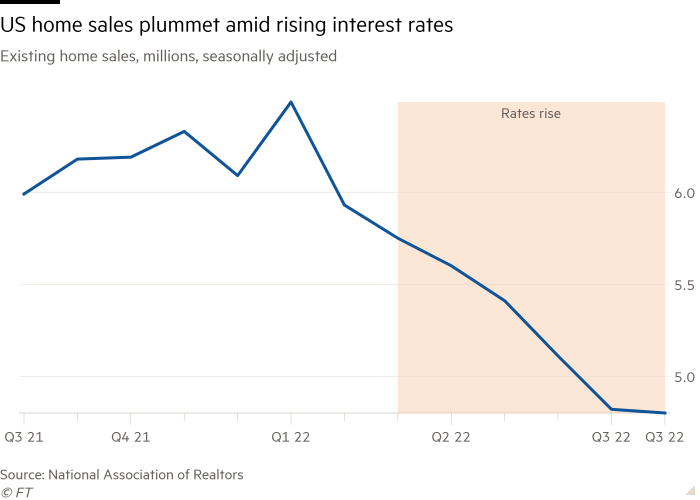

Home sales fell sharply as higher borrowing costs and fears of recession deterred buyers. Almost 20 percent fewer homes were sold in August than in the same month last year, according to the National Association of Realtors. For real estate agents and mortgage brokers, who mostly work on commission, the changing market has decimated their livelihoods and pushed others out of the field altogether.

“There will be a big shakeout,” said Ken Johnson, a real estate economist at Florida Atlantic University who is also a former broker. “There are about 1.5 million real estate agents, but that number will have decreased by 20 percent within 24 months. And they are not the only members of the real estate industry that are very dependent on the volume of transactions. There are these tertiary jobs like the appraisers, the mortgage lenders, all the way down to termite inspectors.”

The mortgage lenders were among the first to remove staff. In April, Wells Fargo, which has more mortgages than any other U.S. bank, laid off nearly 200 loan officers and their executives, blaming “cyclical changes in the broader mortgage environment.” USAA, Citigroup and JPMorgan Chase later announced cuts to their own home loan workforces.

Other independent lenders, including Sprout Mortgage and First Guaranty Mortgage Corp, have filed for bankruptcy.

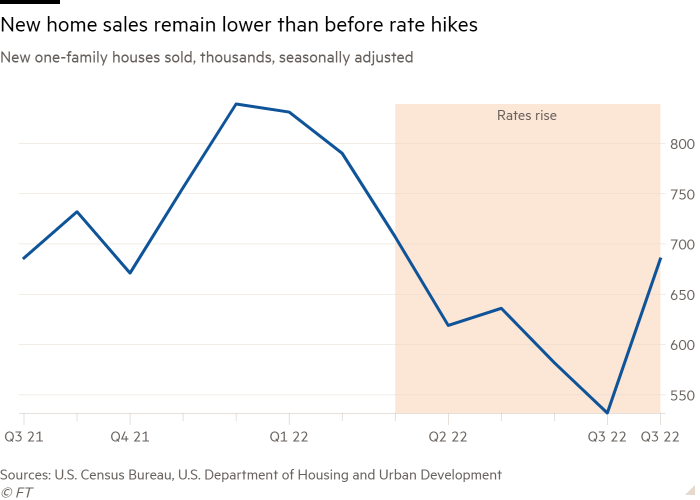

Some brokers refinanced nearly a third of their existing mortgage business as interest rates near record lows in recent years, but applications for refinancing fell 80 percent over the past year, according to the Mortgage Bankers Association. Applications for new mortgages fell 29 per cent. in the same period.

“The way these prices have risen so quickly is almost catastrophic for the industry,” McCoy said.

A record 1.5 million Americans worked as real estate agents during the market’s peak last year. Getting a real estate license is easier than entering other high-earning-potential industries that only require a high school diploma and three to six months of training leading up to a degree. Thousands of new workers rushed in as house prices accelerated during the Covid pandemic, hoping to take advantage of flexible working hours and soaring profits. About 156,000 people joined the National Association of Realtors in 2020 and 2021 alone. That’s 60 percent more than the two years before.

“This growth was much stronger than the home sales opportunities that were available,” said Lawrence Yun, chief economist for the National Association of Realtors. “The reality is that not everyone will survive.”

In June, Redfin and Compass laid off hundreds of employees. Redfin CEO Glenn Kelman told staff he feared “years, not months, of fewer home sales.” Compass said its layoffs were “due to the clear signs of slowing economic growth” before cutting more jobs last month.

Although layoff rates tracked by the Labor Department showed the number of real estate workers whose jobs were eliminated little changed at 16,000 in August, Johnson said most agents work as independent contractors and are not counted in job data. Many will change their business models or take on another job to supplement their income, he predicted.

Shane Skelly, a real estate agent and house flipper in San Diego, “froze” his company’s turnaround arm in June when potential buyers disappeared. His company, Left Coast Realtors, now focuses on facilitating renovations for former clients.

“It wasn’t extreme to begin with, over the last few months it’s really accelerated,” Skelly said. “It’s a little more significant of a correction than I thought it would be.”

Mike Pappas, CEO of Florida-based brokerage The Keyes Company, said he is considering scaling back office and marketing overhead costs in hopes of avoiding having to lay off any of his firm’s 3,300 agents.

“We need to respond dramatically to adjust to the new normal,” Pappas said.

But for many, declining home sales can push them out of the market altogether, said Johnson of Florida Atlantic University.

“Most people in business today have never sold in a 7 percent 30-year mortgage rate environment,” he said. “That mortgage rate got too high, and I think a lot of people are looking around and saying, ‘You know, what’s next?’”

[ad_2]

Source link