Germany leads steepening eurozone downturn in October

The Eurozone economy slipped into a steeper downturn at the

start of the fourth quarter, the rate of decline hitting the

fastest since April 2013 barring pandemic lockdowns. Manufacturing,

and energy intensive sectors in particular, reported the steepest

output loss, but services activity also continued to fall at an

accelerating rate amid the ongoing cost of living crisis and

broad-based economic uncertainty.

Germany reported the steepest economic contraction while growth

in France merely stalled.

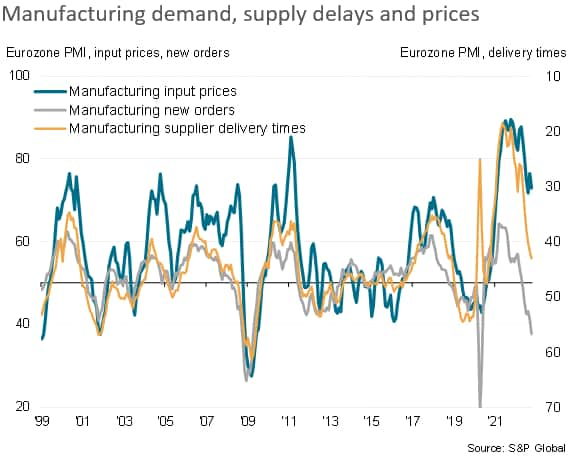

Although supply shortages showed further signs of easing,

inflationary pressures remained elevated amid high energy costs and

upward wage pressures.

Business confidence in the year ahead meanwhile remained mired

at one of the lowest levels seen over the past two years, though

steadied compared to September.

Steepening downturn

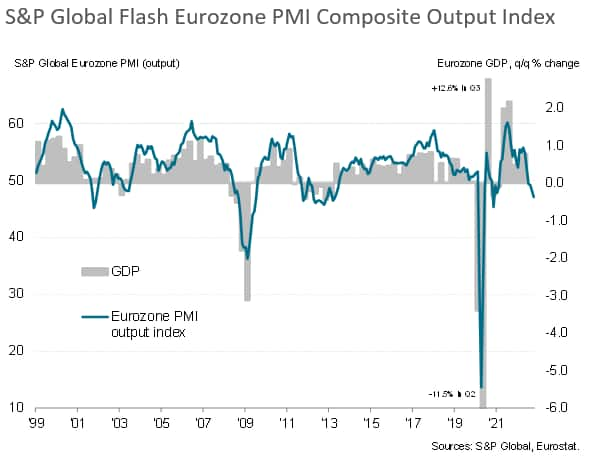

The eurozone economy looks set to contract in the fourth quarter

given the steepening loss of output and deteriorating demand

picture seen in October, adding to speculation that a recession is

looking increasingly inevitable. The S&P Global Eurozone PMI®

Composite Output Index fell from 48.1 in September to 47.1 in

October, according to the preliminary ‘flash’ reading based on

approximately 85% of usual survey responses.

The PMI has now registered below the neutral 50.0 level,

indicating falling business activity levels, for four consecutive

months. The rate of decline has accelerated over this period to

reach the fastest since November 2020. Excluding pandemic lockdown

months, the latest reading was the lowest since April 2013.

Contraction led by manufacturing, and

Germany

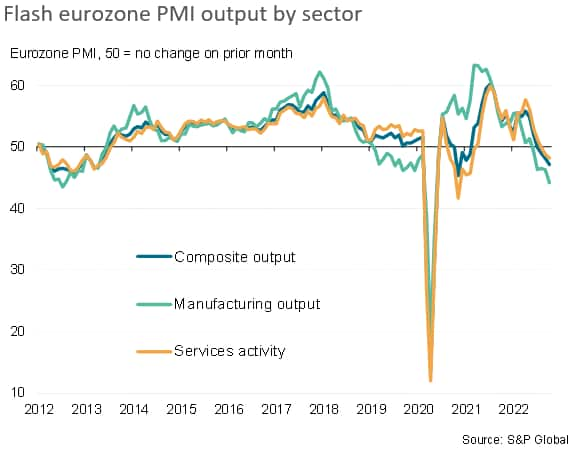

Manufacturing led the downturn, with factory output declining

for a fifth month running and slumping at a rate not seen prior to

the pandemic since July 2012. Service sector output also fell, down

for a third consecutive month, contracting to a degree not

witnessed outside of pandemic lockdowns since May 2013.

Any growth was confined to technology, industrial services and

pharmaceuticals & biotech firms. Some of the steepest downturns

were seen in the chemical & plastics and basic resource

sectors, often reflecting high energy dependencies.

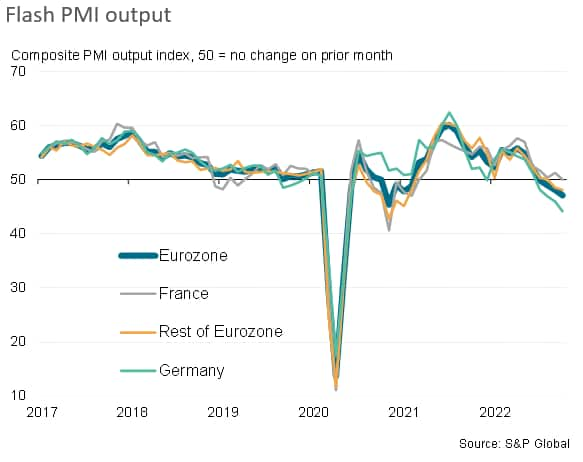

Within the euro area, the steepest decline continued to be

recorded in Germany, where the composite PMI sank to 44.1, its

lowest since May 2020 and, excluding the pandemic, its weakest

since June 2009. Germany’s manufacturing and service sectors both

reported steep and accelerated rates of contraction.

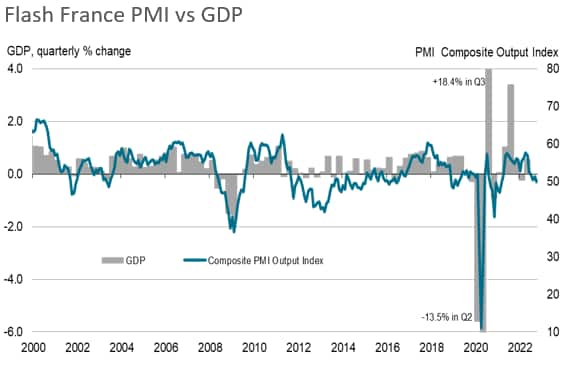

Output meanwhile stalled in France, the composite PMI

registering 50.0 from 51.2 in September, representing the first

month in which output has failed to grow since March 2021. A modest

expansion of service sector output offset a marked (albeit

moderating) decline in manufacturing.

Elsewhere across the region, output fell for the second

successive month, dropping at the fastest rate since January 2021,

and excluding the pandemic since June 2013. A modest decline in

service sector output was accompanied by a steeper fall in factory

production.

Worse to come

While October’s headline flash PMI is consistent with GDP

falling at a modest rate of around 0.2-0.3%, demand is falling

sharply and companies are increasingly growing worried over high

inventories and weaker than expected sales, especially as winter

approaches. The risks are therefore tilted towards the downturn

accelerating towards the year-end.

New orders placed for goods and services meanwhile fell for a

fourth straight month, the rate of loss accelerating to a pace not

seen since December 2012 barring pandemic lockdown months, to

indicate a steepening downturn in demand. Excluding the pandemic,

the drop in manufacturing orders was the sharpest since April 2009,

while the decline in new business inflows into service sector

companies was the steepest since June 2013.

The drop in new orders meant companies continued to rely on

existing backlogs of work to help maintain business activity

levels, causing backlogs of orders to fall for a fourth month in a

row, led by a particularly sharp decline in manufacturing. The

backlogs decline was most marked in Germany, whereas France

reported rising outstanding business.

Business expectations for the year ahead remained subdued,

running at the second-lowest since the early pandemic lockdowns.

Confidence was especially low in manufacturing, and particularly in

Germany, reflecting concerns over energy as well as the rising cost

of living and global growth slowdowns. While sentiment picked up

slightly in the service sector from the previous month, it remained

weaker than at any other time since early-2020 and far below levels

seen earlier in the year, linked principally to concerns over the

rising cost of living and tightening financial conditions.

While employment growth ticked up slightly in October, the

latest gain was the third-lowest seen over the past

year-and-a-half, reflecting job cutting at some firms amid signs of

surplus capacity relative to sales and a broader reticence to hire

amid uncertainty regarding the outlook.

Easing supply chain delays

Although factory output was again subdued in many cases by

component shortages and concerns over energy, October saw the

overall incidence of supply chain delays ease to the lowest for

just over two years. Companies reported fewer component shortages

and improved shipping, albeit often linked to suppliers being less

busy due to weaker demand. Input buying by manufacturers fell at

one of the steepest rates seen since the global financial crisis,

reflecting lower production requirements and increasingly

broad-based deliberate inventory reduction policies amid weaker

than expected sales.

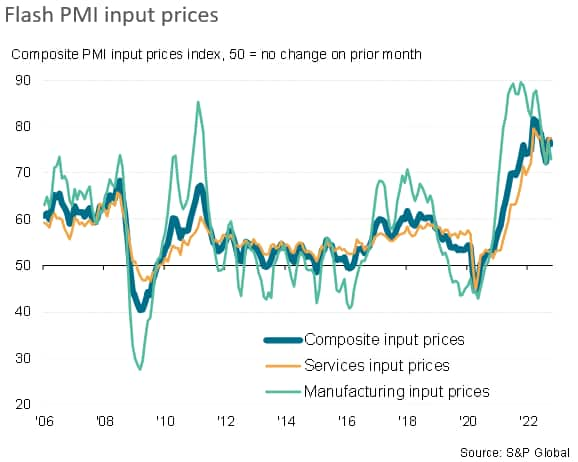

Stickier service sector prices

Although easing raw material supply constraints helped alleviate

some inflationary pressures, rising energy costs and upward wage

pressures ensured the overall rate of input cost inflation remained

highly elevated, easing only slightly from September’s three-month

high (and even increasing slightly in services).

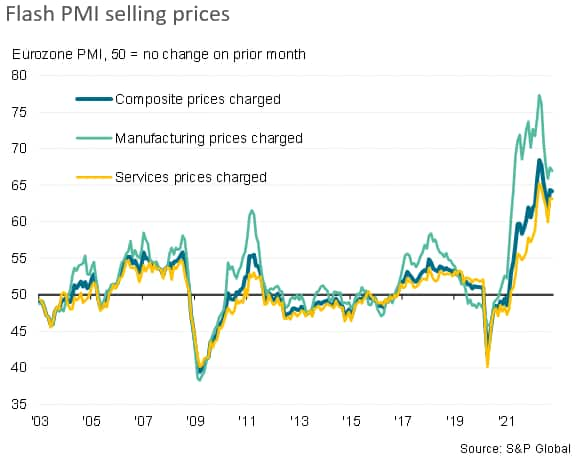

Higher costs fed through to a stubbornly high rate of increase

of prices charged for goods and services, which dipped only

marginally compared to September to register the sixth-largest

monthly increase since comparable data were first available in

late-2002. Rates of selling price inflation cooled only marginally

in both manufacturing and services, in both cases remaining far

higher than anything ever seen prior to the pandemic.

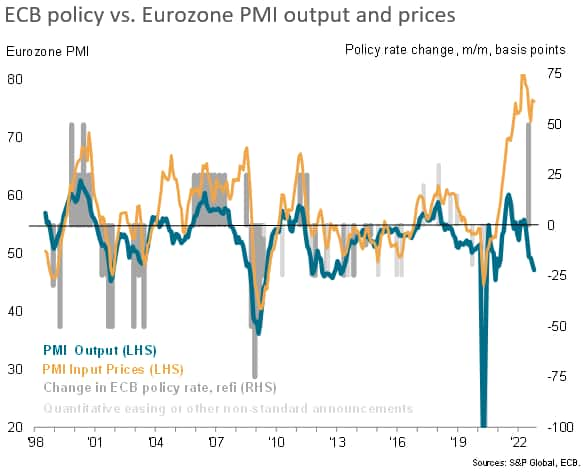

ECB to add to economy’s headwinds

Price pressures therefore remain stubbornly elevated, as rising

energy and staff costs, and the weakened euro, offset any lowering

of commodity prices linked to improving supply conditions. As such,

the elevated survey price gauges will likely add the ECB’s resolve

to tighten policy further in the coming months despite the growing

recession risk. But there will likely also be some growing

discomfort among some policymakers regarding the economic impact of

tightening policy too aggressively in the face of other economic

headwinds.

Chris Williamson, Chief Business Economist, S&P

Global Market Intelligence

Tel: +44 207 260 2329

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]

Source link