Ugly, Tailing 2Y “Halloween” Auction Sees Lowest Foreign Demand Of 2022

With yields tumbling all day tracking the collapse in the dollar, investors hoping to get some concession out of today’s $42BN 2Y auction could kiss said hope goodbye. It may be why when all was said and done, today’s sale of Cusip FQ9 maturing on Halloween 2024 with a cash coupon of 4.375%, was a bust.

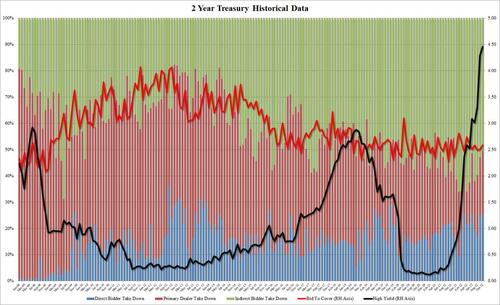

Pricing at 4.460%, the auction stopped at the highest yield since before the global financial crisis, and was also well above last month’s 4.290% amid continued inflation fears and tightening expectations by the Fed. The auction also tailed the When Issued 4.448% by 1.2bps, the third consecutive tail.

The Bid to Cover of 2.587 was not too bad, coming above last month’s 2.51 and just above the six-auction average of 2.572.

The ugly internals however more than offset for this, with Indirects sliding to 50.5% from 52.95%; this was the lowest foreign demand since 45.6% last November (and obviously below the recent average of 59.1%). And with Directs taking 25.3%, Dealers were left holding on to 24.2% of the auction, the highest since January when the Fed started ending QE.

Overall, a poor auction, if understandably so considering the plunging yields leaving no chance for a bond concession today.

[ad_2]

Source link