All eyes on the Dollar Index

Sprott Money/Craig Hemke/10-25-2022

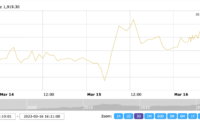

Gold and the US Dollar Index

(2000 to present)

Chart courtesy of TradingView.com • • • Click to enlarge

“All bull and bear markets eventually come to an end,” he says in an advisory posted yesterday at the Sprott website, “and this one in the Dollar Index will end eventually too. When will it end? When the Fed finally halts their rate hike regime, of course. However, you must keep in mind that most ‘markets’ are generally forward-looking and proactive, not passive and reactive. With this in mind, perhaps we can look to the Dollar Index for clues before the Fed pauses and reverses. Maybe we should expect the Dollar Index to top and roll over in advance of this eventual policy shift and not as a response to the shift itself.”

USAGOLD note: Analyst Craig Hemke advises investors to keep an eye on the dollar index for clues as to when gold and silver might shake their current lethargy. He sees a break below the 50-day moving average at 110 on the dollar index as an indicator that “the uptrend has been broken.” Currently, the index is trading at just above the 110 level.

USAGOLD note: Analyst Craig Hemke advises investors to keep an eye on the dollar index for clues as to when gold and silver might shake their current lethargy. He sees a break below the 50-day moving average at 110 on the dollar index as an indicator that “the uptrend has been broken.” Currently, the index is trading at just above the 110 level.

[ad_2]

Source link