I Suggest You Pivot: Stocks Soar After Democrat Senator Urges Powell To End Hikes

Who could have seen this coming? Well, all our readers for one…

Back In July, we wrote “Democrats Prepare To Unleash Hell On Fed Chair Powell For The Coming Recession”, in which we laid out the “cunning” Democrat plan to blame Fed Chair Jerome Powell for the economic hurricane that is imminent, as poll numbers started to slide and the Midterms looked like a disaster:

“It is important for the Fed not to overreach and trigger a recession unnecessarily, as part of its effort to bring inflation down,” said Representative Hakeem Jeffries of New York, the No. 5-ranked House Democratic leader.

“Inflation is a global problem, and is actually not as bad in America as it is in almost every other developed economy in the world,” he told Bloomberg.

Then, in September, none other than Senator Elizabeth Warren unleashed hell on the former lawyer, tweeting that:

“Chair Powell just announced another extreme interest rate hike while forecasting higher unemployment. I’ve been warning that Chair Powell’s Fed would throw millions of Americans out of work — and I fear he’s already on the path to doing so.”

Interestingly, we noted at the time that Senate Baking Committee Chair Sherrod Brown, an Ohio Democrat, defended Powell during an interview on Bloomberg Television. But that all changed on Monday, when in a sternly-worded letter Brown made it clear that he too is on team-fake Indian and that Powell needs to stop the hikes now (which he won’t, but will provide just the right cover for Democrats when the catastrophic job prints start hitting).

“As you know, the Federal Reserve is charged with the dual mandate of promoting maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy. It is your job to combat inflation, but at the same time, you must not lose sight of your responsibility to ensure that we have full employment.

For the first time in decades, we have seen historic job growth, and workers have begun to see wage gains, gains that your prior actions to stabilize the economy helped achieve. Yet, many workers and their families are struggling under the weight of inflation.”

“However, a family’s “pocketbook” needs have little to do with interest rates, and potential job losses brought about by monetary over-tightening will only worsen these matters for the working class. “

Translation: leave inflation alone – which by implication means raise the Fed’s inflation target to what 4%? 5%%? and instead just focus on preventing the economy from getting much worse.

And now, just two days later, yet another Democrat – and certainly not the last – has joined the chorus, when Senator John Hickenlooper sent a letter to Powell urging the Fed Chair to “pause and seriously consider the negative consequences of again raising interest rates.”

Translation: Democrats have either finally realized that a market crash does not poll well…

Biden about to find out what polls worse: recession and bear market or runaway inflation.

— zerohedge (@zerohedge) May 20, 2022

…. or, worse, have seen next month’s nonfarm payrolls print and it is clearly a disaster.

In any case, what we said long ago when we disagreed with Zoltan Pozsar – namely that the Fed’s inflation fight will end the moment politicians tell the “independent Fed” to end it – is starting to come true. As a reminder, this is what we argued back in August in “Zoltan Pozsar: Powell Will Push The Economy Into A “Depression” To Curb Inflation”:

The problem with this line of thinking is that Pozsar thinks anyone – whether Congressional Republicans or Democrats – will agree to a “depression” just to contain inflation. Spoiler alert: they won’t as it means an immediate end of all their political (and all other careers). Instead, they will browbeat Powell and the Fed, into doing just enough to avoid this outcome even if it means raising the inflation target, which we are 100% certain is how this episode ends: with the Fed raising its inflation target quietly from 2% to 3% or more, with the usual hedonic adjustments of course.

To summarize: the problem with Pozsar’s latest note is that it is too rational, too logical, and it reduces to the following – US society can be fixed at the individual level by realigning incentives, motivations and beliefs, and the Fed will do what is right even if it means the collapse of the US political system. Alas, that will never happen, and that’s why Zoltan’s argument fails. After all, it’s far easier to simply print a few trillion (again) and kick the can for a few more years and dump the plate of troubles on some other unhappy politician. It’s also why the gating constraint here is not inflation but the dollar reserve currency status: at the end of the day, the Fed will devalue the dollar to permit both more monetary and Fiscal easing thus keeping both the lower and upper classes happy, and it will keep doing so until it risks hyperinflation – pushing the dollar-based system to the point beyond which the world will no longer accept it; after all that was the endgame since the day the Fed was launched in 1913. Whether the system is actually pushed beyond said point, well that’s the real $64 trillion question.

… and after tumbling earlier in the session, stocks have exploded higher following news of the letter as they too now agree with our take…

… with yields and the dollar tumbling.

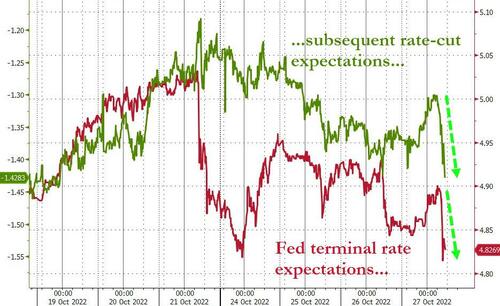

…and short-term interest rate markets shifting significantly dovishly, from ‘pause’ to ‘pivot’ with rate-hike expectations sliding and subsequent rate-cut expectations spiking…

The only wildcard here is the senile occupant of the White House himself. For now, he appears more focused on inflation:

- *BIDEN: WE NEED TO DO MORE TO BRING PRICES DOWN

…but the moment the monthly payrolls report hits and is worse than -100,000 all bets are off and the time to pivot is here.

[ad_2]

Source link