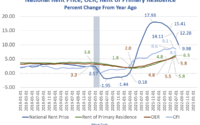

Real time updates of big Fed rate hike and Jerome Powell’s news conference

Fed statement language ‘somewhat’ surprising, BMO’s Lyngen says

BMO capital markets head of U.S. rates strategy Ian Lyngen said he was surprised by some of the Fed’s statement language.

“‘Cumulative tightening’ and ‘lagged impact’ suggest that this will be the last 75 bp hike and in December the move will most likely be 50 bp. We’re somewhat surprised to see the ‘soft pivot’ in the statement itself and we expect that Powell will double down on this narrative at the press conference. Therefore, the bullish move has more room to run,” Lyngen said in a statement.

— Yun Li, Fred Imbert

What changed in the new Fed statement

Fed says it will ‘will take into account the cumulative tightening of monetary policy’

This is the language from the Fed statement traders appear to be keying on:

The Fed said it will “take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

— Jeff Cox

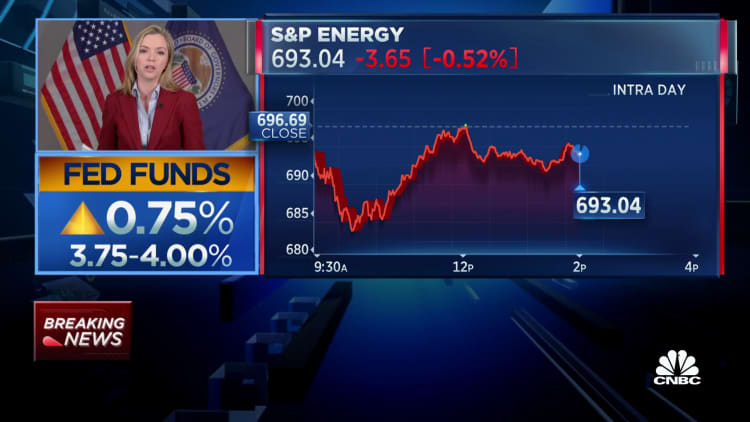

Stocks jump after Fed rate hike

The major averages jumped after the Federal Reserve raised rates by 75 basis points, as was widely expected. The Dow traded more than 200 points higher, or 0.9%. The S&P 500 gained 0.5%, and the Nasdaq Composite advanced 0.4%.

For a full breakdown of today’s market action, check out or live blog.

— Fred Imbert

Fed raises rates

Investors may need to parse Fed closely for signs of a change in rate hikes

The Federal Reserve’s potential move to smaller rate hikes may not be explicit in the policy statement and Jerome Powell’s press conference on Wednesday, said James Ragan, director of wealth management research at D.A. Davidson

“Will there be discussion about the potential for 50 basis points in December? Probably not. I don’t think he’ll want to be that specific,” Ragan said.

Ragan pointed to Powell previously saying that the Fed had hiked to the low end of a restrictive range as the example of the type of comment that investors are looking for.

“If they go to 3.75-4%, how restrictive do they view that? I think that’s going to be important,” he said.

Discussions about the state of the economy will also be closely monitored, Ragan added.

— Jesse Pound

Here’s what to expect from the Fed

The Federal Reserve is expected to announce that it is raising its fed funds target rate range by three-quarters of a point.

The Fed is also widely expected to signal that it could slow down the pace of rate hikes, and the market is pricing in a good chance of a smaller 50 basis point hike for December. A basis point equals 0.01 of a percentage point.

If the Fed decides to signal smaller hikes are coming, Fed Chairman Jerome Powell could be the messenger when he briefs the media at 2:30 p.m. ET.

Powell could make such a comment in response to a question, according to Jim Caron of Morgan Stanley Investment Management. But Caron stresses that Powell will not provide a definitive comment.

“He’s going to hide behind the data,” said Caron. The strategist said Powell will have to be careful in how he crafts the statement because he could raise market expectations for a less aggressive Fed.

“It’s very hard for him not to get himself in trouble just in the normal course of discourse to say we are going to step down if the inflation data weakens,'” he said.

The hike would be the fourth 75 basis point hike in a row. A basis point equals 0.01 of a percentage point.

–Patti Domm

Market snapshot heading into Fed decision

Here’s a look at where markets stand about an hour before the Fed delivers its monetary policy decision:

— Fred Imbert

BlackRock’s Rick Rieder thinks the Fed will lean hawkish

Investor hopes of a dovish Fed pivot have grown recently, but BlackRock’s Rick Rieder thinks the central bank will maintain a more aggressive policy stance.

The firm’s chief investment officer of global fixed income said he expects Chair Jerome Powell to sound somewhat hawkish at his 2:30 p.m. ET news conference.

“He’s got to be really careful not to be seen as easy or pivoting,” said Rieder. “I think he’s got to draw the line on ‘inflation is our objective’… I think he’s got to be aggressive about that. If he blinks and financial conditions ease too much…that’s not the direction he or they want to go down.”

CNBC Pro subscribers can read more here.

— Patti Domm, Fred Imbert

There are two words investors want to hear from the Fed

As the Fed delivers its latest monetary policy decision, there are two words investors will be looking for: “step down.” As in, Wall Street will be looking for the central bank to “step down” from its current tightening path. The term was used by San Francisco Fed President Mary Daly.

The Fed isn’t expected to stop raising rates anytime soon, but hints that this could be the last 0.75 percentage point increase could soothe a beaten-down stock market.

CNBC Pro subscribers can read more here.

— Jeff Cox, Fred Imbert

[ad_2]

Source link