Fed’s Balance Sheet Drops by $289 Billion from Peak: November Update on Quantitative Tightening

We also keep an eye on Primary Credit and look at the Fed’s deal with the Swiss National Bank.

By Wolf Richter for WOLF STREET.

Total assets on the Federal Reserve’s weekly balance sheet, released today, with balances as of November 2, dropped by $82 billion from the October 5 balance sheet, to $8.68 trillion, the lowest since December 8, 2021.

Treasury securities mature mid-month and at the end of the month, which is when they roll off the Fed’s balance sheet. Today’s weekly balance sheet included the Treasury roll-off on October 31.

Treasury securities: Down $196 billion from peak.

Since the peak in early June, $196 billion in Treasury securities have rolled off the Fed’s balance sheet, reducing the balance of Treasury securities to $5.57 trillion, the lowest since November 17.

Over the four weeks since the October 5 balance sheet, $59 billion have rolled off:

- Treasury notes and bonds (2-30 years): -$46.2 billion

- Treasury bills (1 year or less): -$12.6 billion

- Treasury Inflation Protected Securities (TIPS): unchanged

- TIPS related inflation compensation: -$0.07 billion

Mortgage-backed securities: Down $62 billion from peak.

Since the peak, the balance of MBS had dropped by $62 billion. Over the past four weeks, the balance declined by $20 billion, to $2.68 trillion.

MBS come off the balance sheet mostly via pass-through principal payments that occur when the underlying mortgage is paid off or when regular mortgage payments are made. Mortgages are paid off mostly when the home is sold or when the mortgage is refinanced. Since mortgage interest rates have spiked, refinance activity has collapsed (read: Mortgage Lender Woes), and mortgage payoffs when the home is sold have plunged as home sales have plunged by 30% from two years ago. So the pass-through principal payments turned from a torrent in 2021 to a creek now.

The inflow of new MBS onto the balance sheet petered out in October after the Fed stopped buying MBS in mid-September.

Back when the Fed was still buying large amounts of MBS, and when there was still a torrent of pass-through principal payments, the weekly mismatch in timing between the two created the jagged line in the chart. Since the large inflows have ended, there are no more upticks. The downticks represent the pass-through principal payments:

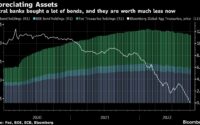

Unamortized Premiums: Down $36 billion from peak.

Like everyone who buys bonds in the secondary market, the Fed had to pay a “premium” over face value when it bought securities that had been issued years earlier when interest rates were higher, and that therefore came with a higher coupon interest rate than the market yield at the time of the purchase.

The Fed books the face value of securities in the regular accounts, and it books the “premiums” in an account called “unamortized premiums.” It amortizes the premium of each bond to zero over the remaining maturity of the bond. When the bond matures, the Fed receives face value for the bond, and it rolls off the balance sheet. By that time, the premium has already been fully amortized.

Unamortized premiums have dropped by $36 billion from the peak in November 2021, to $320 billion:

The to-do over the Swiss National Bank.

In October, there was some catastrophist chatter in some corners of the blogosphere about the Fed suddenly and “quietly” handing the Swiss National Bank a gazillion dollars.

In reality, the Fed and the Swiss National Bank engaged in dollar liquidity swaps on the Fed’s swap line with the SNB that has been operational for many years. These were 7-day swaps, and after 7 days, the Fed gets its dollars back.

In total, they undertook five 7-day swaps in a row, starting on September 14. The last swap, the largest one, amounting to $11.1 billion, matured on October 27. Since then, there have been no swaps with the SNB, and the balance with the SNB is now $0.

This chart shows the use of the swap lines during times of high financial frictions. That little dot at the end is the SNB:

Keeping an eye on “Primary Credit.”

The Fed lends money to the banks and charges interest on these loans. Yesterday, as part of its rate hikes, the Fed hiked the Primary Credit rate by 75 basis points to 4.0%, which is what it now charges banks when they borrow at the “Discount Window.”

In March 2020, Primary Credit balances spiked to $50 billion. During the Financial Crisis, Primary Credit spiked to $110 billion. Both faded quickly and then remained at very low levels.

When the Fed started hiking rates in early 2022, Primary Credit began rising just a little. At the peak in early October, Primary Credit amounted to $7.5 billion. On today’s balance sheet, it fell to $4.4 billion. So this is something we’re going to keep an eye on.

QT is the opposite of QE.

With QE, the Fed created money and with it purchased securities via its primary dealers from the financial markets, and this money then started chasing assets, which inflated asset prices and pushed down yields, mortgage rates, and other interest rates.

QT works in the opposite direction and does the opposite and is part of the explicit tools the Fed is using to crack down on this raging inflation that was in part the result of years of QE. But for years, QE didn’t trigger consumer price inflation – it just triggered asset price inflation, giving all central banks lots of opportunities to learn all the wrong lessons. Until it suddenly triggered massive consumer price inflation. And now we have this huge mess.

And how we got to Raging Inflation:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link