International interest in China bonds wanes amid global debt market pain

|

| Smoke emissions in Hangzhou, China. Unfavorable debt conditions are having an impact on green bond issuance. Source: Xia yuan/moment via Getty Images |

Investor interest in China’s internationally-aligned green bonds may slide in the next few months over unfavorable debt market conditions, even as new bond rules boost longer-term prospects.

Internationally aligned bonds are being impacted by recent macroeconomic factors, such as rising U.S. interest rates and inflationary pressures, that make it unfavorable to issue debt, said Terence Lau, capital markets partner at law firm Linklaters.

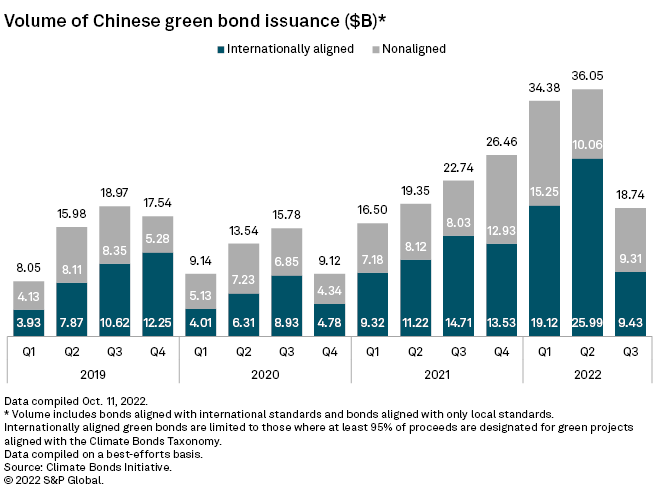

Issuance of internationally aligned green bonds, usually denominated in U.S. dollars and bought primarily by global investors, dropped to $9.43 billion in the July-to-September quarter from $14.71 billion in the prior-year period, according to data from Climate Bonds Initiative, a U.K.-based green debt tracker. This also marked a sharp decline from $25.99 billion in the previous quarter. Low issuance is typically indicative of low investor demand.

Still, new green bond rules issued by China in July are poised to boost demand for aligned bonds — bonds that conform to internationally accepted green standards — in the long run. The new rules require all green bond proceeds to go toward green projects, compared to 50% previously.

“In the longer term, it should also drive further capital allocation from international investors of China green bonds as well as give Chinese issuers greater opportunities to attract investors from different markets,” Lau said.

The effort to harmonize China’s definition of the financial instrument with other parts of the world will help standardize benchmarks and increase comparability, which should boost liquidity and tradability between green bonds issued in China with those from other markets, analysts said.

Robust local demand

The new rules will deter issuers who are not truly committed to investing in green projects and are only trying to raise funds under the guise of ‘greenwashing’, said Andrew McGinty, Hong Kong-based partner at law firm Hogan Lovells. They will also reduce foreign investors’ concerns on use of proceeds.

“Green bonds will be considered an attractive market given China’s focus on certain key sectors such as electric vehicles, batteries and renewable energy manufacturing that provide a good range of potential targets for investing funds raised from green bond issuance,” McGinty said.

The harmonized rules, however, may be less relevant for local investors.

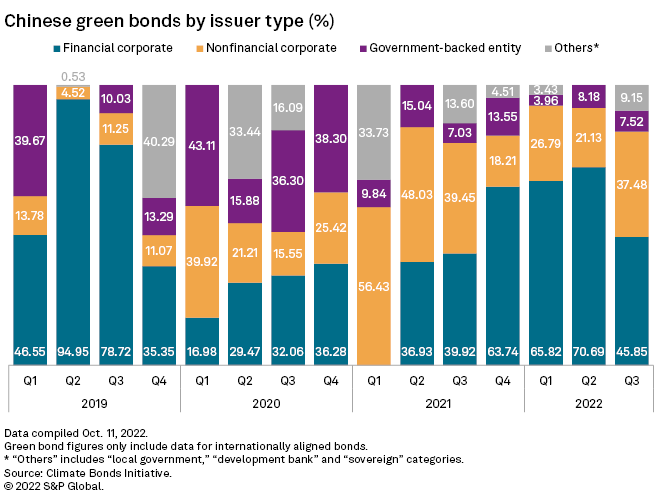

“While it might make it easier for international investors to administer their portfolios, I don’t think it will be a major change to the demand and supply dynamics for domestic market participants, which make up the vast majority of the overall market,” said Raymond Wong, emerging market portfolio manager at Legal & General Investment Management, an asset management firm. Domestic investors currently buy nearly 90% of China’s green bond issuances, Wong said.

Issuance of nonaligned green bonds — bonds aligned to Chinese standards only — in the third quarter increased to $9.31 billion from $8.03 billion in the prior-year period.

“China has actually been reducing rates and increasing liquidity on the onshore market, and so you probably see some sort of more stable issuance volumes in the China onshore market,” Linklaters’ Lau said.

The need for green funds in China, the world’s biggest polluter, is expected to rise as the country expands its renewable energy capacity. The world’s most populous nation aims to reach peak emissions by 2030 and become carbon neutral by 2060. Still, China’s coal production and consumption are likely to rise in the near term as the country’s top leaders highlighted energy security during the National Congress of the Chinese Communist Party. Coal will continue to be a vital part of China’s energy mix following the global power crunch stemming from Russia’s invasion of Ukraine in early 2022, until renewable power supplies can meet energy needs.

“I do absolutely expect that based on domestic policy wording and some of the pronouncements from major energy companies [state-owned enterprises] within China that they are looking to increase renewable energy investments overseas,” said Cory Combs, associate director of Trivium China, a think tank.

China is not expected to set any bold new climate targets at the 27th U.N. Climate Change Conference, according to S&P Global Commodity Insights.

[ad_2]

Source link