Market Liquidity Collapses As Usage Of Fed’s Foreign Reverse Repo Hits Record $351BN In Biggest Weekly Jump In History

A few weeks ago, we published several articles in a row explaining how the Fed’s relentless tightening had not only sent the dollar soaring (sparking a global margin call and forcing foreign central banks to pick between preserving financial stability and runaway inflation, something we will discuss further later today), but pushed US capital markets – especially Treasuries – to the edge of breaking. This eased a bit in mid-October when another modest, technically-driven bear market rally eased financial conditions as stocks jumped by 10%, but then it all came crashing down again when first the tech giants reported catastrophic earnings, and then Powell did a historic rugpull for the ages. The result was not only the biggest post-FOMC market dump in history, but another sharp tightening in financial conditions which has once again pushed liquidity in US financial markets to the breaking point.

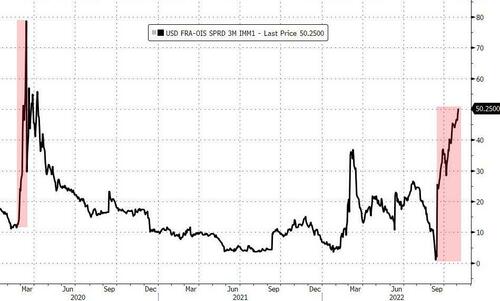

Exhibit A: the infamous FRA-OIS (for those unfamiliar with this key topic, read this) has spiked sharply and is now back to levels last seen just before the Fed was forced to inject trillions to unblock the US financial system. Yes: something is badly broken with the plumbing of the US financial system, and it is getting worse by the day.

[ad_2]

Source link