Wisdom Tree/Staff/October 2022

“Gold stands out as an asset that performs well in recessionary scenarios. As recessionary risks rise, we expect gold to outperform most other asset classes. Gold is facing headwinds from a strong US dollar and a bond sell-off. Despite that, it is holding value better than expected.”

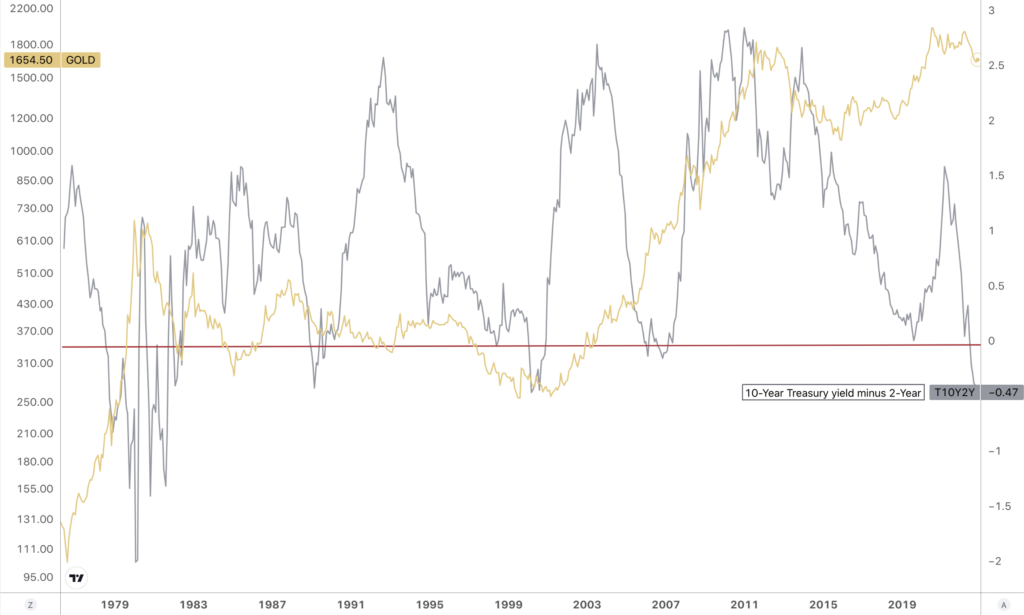

USAGOLD note: Wisdom Tree, the Dublin-based investment firm, says the inverted yield curve confirms that the United States is already in a recession. “Bear flattening inversions have been good for gold in the past,” it says. “Today, we are in one of the strongest bear-flattening inversions we have seen since 1981. That points to a source of strength for gold we have not seen in decades.”

Yield inversions and gold

(10-year Treasury yield minus 2-year, gold log scale)

Chart courtesy of TradingView.com • • • Click to enlarge