Stock futures edge higher ahead of midterms

Stock futures edged higher Tuesday morning as investors await the outcome of the midterm elections in the U.S.

Futures tied to the S&P 500 (^GSPC) inched higher by 0.2%, while futures on the Dow Jones Industrial Average (^DJI) ticked higher by 0.1%. The technology-heavy Nasdaq Composite (^IXIC) rose by as much as 0.5% in premarket trading.

On Monday, U.S. stocks rose ahead of another week of potential market-moving events: corporate earnings, midterm elections, and inflation data.

Investors are focused on Tuesday’s midterm elections that will determine control of the House and Senate for the remainder of President Joe Biden’s first term. Historically, Wall Street has preferred a split Congress or White House, with political gridlock that could impede major policy changes, an outcome that investors see as favorable for equities.

According to JPMorgan’s latest client survey, 39% of respondents were split on whether the U.S. midterm elections will be a positive catalyst for risk markets or non-event, while 21% expected negative implications. Regardless of the winner, some strategists argue that midterm outcomes have a “modest” influence in financial markets.

“The overall near-term implications of the 2022 U.S. Midterm Elections are quite modest for FX markets,” Meera Chandan, FX strategist at JPMorgan, wrote in a note to clients. “Markets should thus continue taking guidance more from the Fed’s monetary policy decisions than from any new large fiscal packages. One wildcard worth flagging is the risk of renewed uncertainty around the debt ceiling.”

Another closely watched item this week will be the Thursday release of October inflation data. Economists surveyed by Bloomberg expect headline CPI at an annual rate of 7.9%, down from 8.2% the month before. Even if the report shows prices starting to moderate, core CPI is far above the Fed’s comfort zone.

“The problem is going to be that in month over month terms, I think we’re still going to see a fairly strong core CPI,” Franklin Templeton Fixed Income CIO Sonal Desai told Yahoo Finance Live on Monday. “And I don’t think that a combination like that, together with the relatively strong jobs numbers we got on Friday, it’s not going to give the Fed much comfort in terms of changing the path which was outlined by Chairman Powell last week.”

Some Wall Street banks, including UBS, expect the U.S. to head into a “hard landing.” Indeed, Federal Reserve Chair Jerome Powell said the path to achieve a “soft landing” has narrowed because the Fed hasn’t seen inflation coming down.

“The US economic expansion already looked precarious. After one of the most rapid recalibrations of monetary policy in several decades, the full effects remain to be seen,” Jonathan Pingle, managing director and chief U.S. Economist at UBS, wrote in the bank’s Global Economics & Markets Outlook 2023-2024 report.

“With meaningful imbalances remaining in the US economy as a result of the pandemic, we expect 2023 to bring an economic downturn, or correction. The good news, resolving the tensions we think sets the US economy up after 2023 for better years ahead,” he added.

Earnings reports also continued to trickle in on Tuesday. Among the highlights:

-

Planet Fitness (PLNT): The fitness gym posted third-quarter profit and revenue that topped expectations and raised its full year growth outlook as membership reached a record with joins back to pre-pandemic seasonal trends.

-

DuPont de Nemours (DD): The chemicals giant posted a beat for their third-quarter earnings and reaffirmed its full-year guidance.

Disney (DIS), AMC Entertainment Holdings (AMC), Affirm Holdings (AFRM), and Lucid Group, Inc. (LCID) are set to report earnings after the bell on Tuesday.

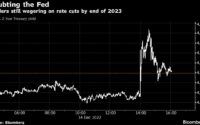

In the bond market, the yield on the 10-year Treasury note edged up 4.205% Tuesday. Oil markets, meanwhile, Brent crude, the international benchmark, weakened for a second day, falling to $97.71 a barrel. The U.S. dollar index rose slightly after falling the most over the past three trading sessions since 2020.

—

Dani Romero is a reporter for Yahoo Finance. Follow her on Twitter @daniromerotv

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

[ad_2]

Source link