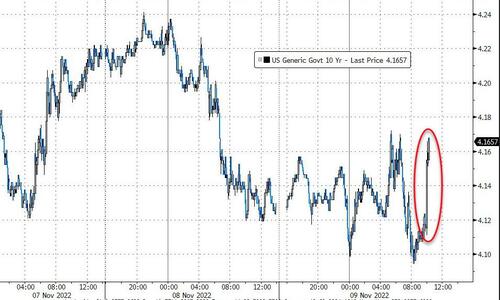

Yields Surge After Disastrous 10Y Auction, Biggest Tail In Over 6 Years

After yesterday’s average $40bn 3Y Treasury sale, there wasn’t much angst ahead of today’s refunding sale of $35BN in 10Y paper (Cusip FV8). Well, there should have been because the just concluded sale of 10Y notes was gruesome.

The high yield of 4.14%, not only the highest in this tightening cycle (and well above last month’s 3.93%) and also the highest since the prior rate hike cycle which culminated with the Lehman collapse, tailed the When Issued 4.106% by 3.4 bps. This according to our data, was the biggest tail since at least 2016 and the 8th tail in the past 9 auctions.

The bid to cover of 2.23 was also dismal, dropping from 2.34 last month and the lowest since August 2019.

Not surprisingly, the internals also disappointed: Indirects of 57.5% were slightly above last month’s 56.8%, but away from the ugly October auction, foreigners took down the lowest since March 2021 (the six-auction average was 64.8%). And with Directs taking down 18.1% in line with the recetn average of 18.8%, meant that Dealers were holding on to 24.4%, the most since March 21 when the Fed was still actively engaging in QE and taking down all the paper Dealers didn’t want (and now they are stuck holding).

Overall, this was an appallingly ugly 10Y auction, and one which understandably sent yields to session highs across the curve in a day when everything feels like it will break courtesy of the FTX implosion.

[ad_2]

Source link