Why Goldman sees gold soaring 30% when the Fed starts cutting rates

ZeroHedge/Tyler Durden/11-9-2022

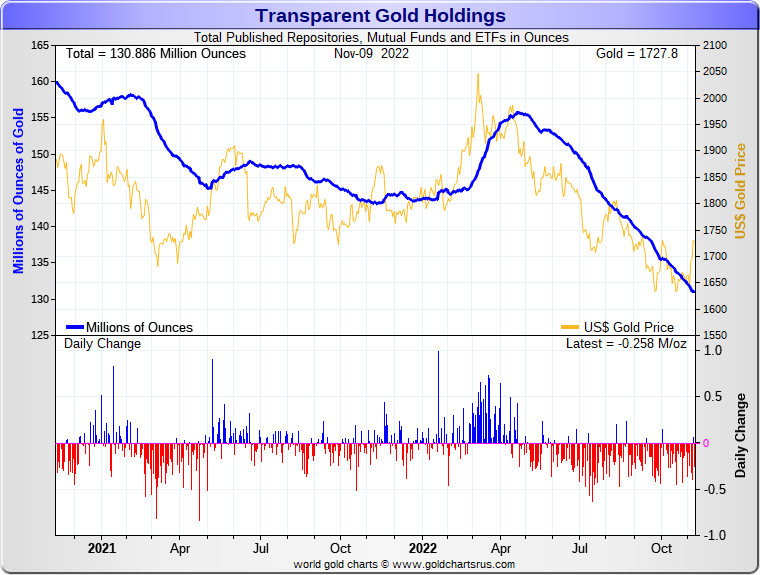

Chart courtesy of GoldChartsRUs

“This paradoxical divergence between record central bank demand, and depressed pricing due to Fed policies, creates – according to Goldman strategist Mikhail Sprogis – gold’s return asymmetry: as he writes, ‘EM CB demand appears to be a reflection of geopolitical trends that have been years in the making vs a one-off spike.’ As a result, the Goldman banker believes that structurally higher EM CB demand creates an asymmetric payoff for gold as it provides a floor to gold if further ETF liquidation occurs in response to further hawkish Fed surprises. Meanwhile, in a scenario where a US recession leads to a turn in the US monetary cycle – which it will, it’s only a matter of time before the Fed breaks something badly – Goldman estimates that gold could rally by 20-30% depending on the degree of Fed cuts.”

USAGOLD note: Goldman assesses the net effect of global central banks reinstituting gold as an important part of their asset structure. Zero Hedge calls it a “put” on the gold price as it offsets current ETF selling. Not mentioned in this long review of Goldman’s position on gold is the fact that the ETF selling could suddenly reverse to buying – doubling down on the stress to already stretched physical supplies. Wall Street financial institutions and funds, the primary market for ETF gold, have a history of going from bearish to bullish on gold (vice versa) in a heartbeat given the proper incentive.

USAGOLD note: Goldman assesses the net effect of global central banks reinstituting gold as an important part of their asset structure. Zero Hedge calls it a “put” on the gold price as it offsets current ETF selling. Not mentioned in this long review of Goldman’s position on gold is the fact that the ETF selling could suddenly reverse to buying – doubling down on the stress to already stretched physical supplies. Wall Street financial institutions and funds, the primary market for ETF gold, have a history of going from bearish to bullish on gold (vice versa) in a heartbeat given the proper incentive.

[ad_2]

Source link