Powell’s Favorite Sentiment Signal Shows Inflation Expectations Rising, Confidence Crashing

After yesterday’s exuberant response to a very slight rollover in core CPI from 40 year highs, all eyes are switched to Jay Powell’s latest signal of public willingness to believe The Fed has this ‘inflation thing’ under control – UMich inflation expectations – which unexpectedly rose in October.

The preliminary November data shows that inflation expectations rose for the second straight month with 1Y exp up from 5.0% to 5.1% and 5-10Y exp up from 2.9% to 3.0%…

Source: Bloomberg

Analysts expected preliminary November headline sentiment to slow, led by a drop in current conditions. They were right but the order of magnitude is considerable as the headline print plunged from 59.9 to 54.7 (59.5 exp) led by a collapse in current conditions.

This has erased over half the gains during the rebound since June.

Source: Bloomberg

Every political cohort saw sentiment decline in the early November data…

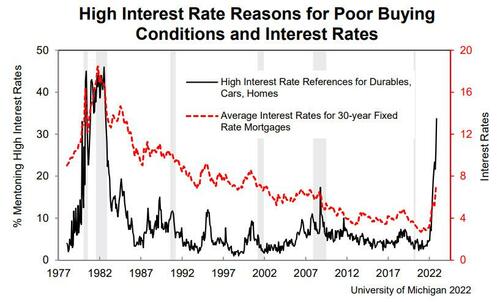

All components of the index declined from last month, but buying conditions for durables, which had markedly improved last month, decreased most sharply in November, falling back 21% on the basis of high interest rates as well as continued high prices.

The report showed that nearly half of consumers said inflation was eroding their living standards, leading many from lower- and middle-income families to change their spending habits.

“Higher-income consumers, whose outlooks were darkened by continued turbulence in stock and housing markets, will likely pull back their spending going forward,” Hsu said.

“With overall sentiment remaining low, these factors highlight the risk of recession in the quarters ahead.”

Homebuying conditions crashed to a new record low…

Source: Bloomberg

“Continued uncertainty over inflation expectations suggests that such entrenchment in the future is still possible,” Joanne Hsu, director of the survey, said in a statement.

[ad_2]

Source link