Of Two Minds – Asymmetries, Distortions and Denial

November 14, 2022

When bubbles pop, it’s natural selection at its most unforgiving: “adapt or die,” and those who ignore

or discount consequential asymmetries will have a very difficult time navigating the triage.

After years of relative stability, it seems asymmetries, distortions and denial are playing out in

unexpectedly destabilizing ways. These complex and often opaque dynamics are interacting with each other

and reinforcing each other in difficult to predict ways.

No wonder instability is the new stability.

Asymmetry comes in many forms. Advantages and disadvantages, weaknesses and strengths–these terms describe

asymmetry in terms of adaptive / selective pluses or minuses and in relative superiority or inferiority.

Asymmetric dominance is not always an adaptive advantage, as it nurtures a very dangerous over-confidence and hubris.

Thus the many accounts of dominant tech companies being overtaken and consumed by small rivals whose asymmetric

advantages were discounted or not recognized by the over-confident major power.

This is the core concept in asymmetric warfare: turn the opponent’s dominance into a liability, and expose

them to unexpected asymmetries they are unprepared to counter.

Then there are the stories of entities with asymmetric advantages which they fail to exploit, squandering

opportunities to further or secure their dominance.

There are also many accounts of apparent dominance resting on asymmetries of vulnerability in metrics such as

training, pilot replacement, supply chains and various “glass jaws” which shatter on contact despite apparent

superiority in quantity and quality.

Distortions generate asymmetries of fragility as the pendulum eventually reaches a point where distorting forces

can no longer advance or contain the inevitable snap-back as extremes revert to the mean and the pendulum

swings to the other extreme: scarcities become gluts, etc.

Denial plays a key role in furthering distortions and overplaying asymmetries. A common form of denying

the risks of distortion is “this time it’s different,” but that doesn’t exhaust the human ingenuity invested in

other forms of denial. Another common form is to remain confident that past dominance predicts the permanence of

future dominance, when history suggests the opposite: hubris and passive over-confidence breed failure and collapse.

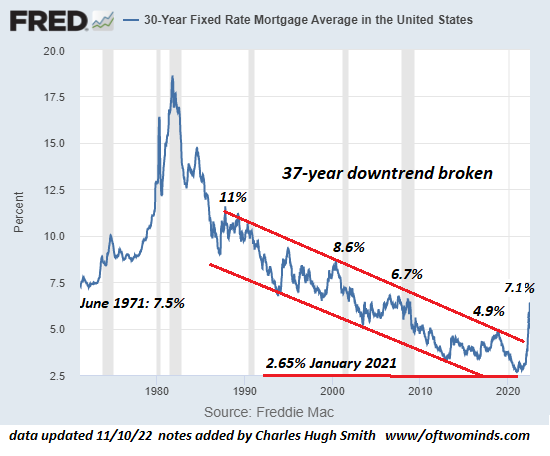

Consider these dynamics in light of the global housing bubble. As the chart below shows, central banks

suppressed interest rates (and thus mortgage rates) for decades as a distortion designed to foster growth. What it

fostered were credit-asset bubbles and wealth/income inequality. Now the global housing bubble is popping as

interest rates as distortions are never permanent.

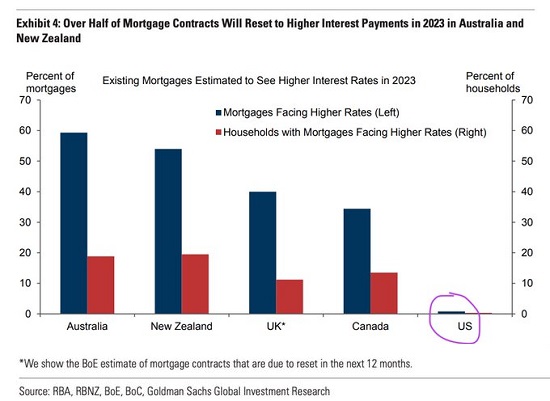

As the second chart illustrates, the global housing bubble has numerous asymmetries, many of which are not

yet recognized as being consequential. This chart displays the asymmetric dearth of mortgages

in the U.S. that will adjust higher as rates rise and the consequentially larger share of mortgages

in Australia, New Zealand, the U.K. and Canada that will adjust higher as rates rise.

The inevitability of the bubble popping was set aside (denial), while the financial distortions that inflated the

bubble were deemed permanent. Beneath the confidence and faith in the permanence of distortions, asymmetries

piled up, unrecognized or discounted.

Now that the bubble is popping, those asymmetries will loom ever larger. The selective advantages of some

asymmetries and the catastrophic fragilities created by others will play out in the years ahead. Some housing

markets will deflate, others will crash. Some with stabilize and recover, some will cascade down to a new low and not

recover. When bubbles pop, global capital flows tend to ignore ideologies, distortions and denial in favor of

transparency, liquidity and stability.

These global capital flows will fuel a new set of asymmetries that will reinforce the strengths of the most adaptable

and the weaknesses of the least adaptable–the opaque, corrupt, sclerotic, illiquid. These asymmetries will become

increasingly consequential, and only those who recognize the asymmetries for what they are will grasp the

opportunities to escape doomed markets and situations and secure stakes in the most adaptable markets and situations.

When bubbles pop, it’s natural selection at its most unforgiving: adapt or die, and those who ignore

or discount consequential asymmetries will have a very difficult time navigating the triage.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Richard C. ($5/month), for your marvelouslyy generous pledge |

Thank you, Sam W. ($5/month), for your splendidly generous pledge |

|

|

[ad_2]

Source link