Central banks in stagflation and debt traps

November 18, 2022

Project Syndicate/Interview of Nouriel Roubini/11-15-2022

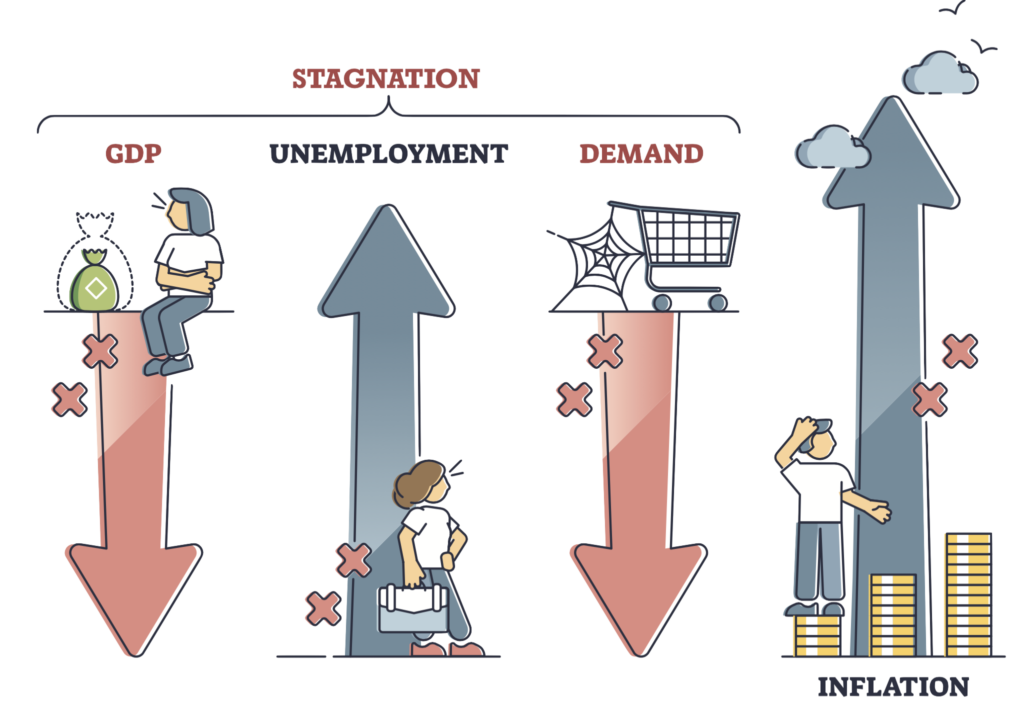

“Historically, financial innovation without proper regulation and supervision has led to asset inflation, which fuels bubbles that eventually burst. Today, we are also facing goods and services inflation, owing to negative aggregate supply shocks and the effects of fiscal and monetary policies that were too loose for far too long. With high inflation, the debasement of fiat currencies is a rising risk.”

USAGOLD note: The latest from Stern School’s Roubini…… He echoes a familiar refrain – central banks are “damned if they do, damned if they don’t.” Roubini has recommended gold for defensive purposes consistently over the past several months.

USAGOLD note: The latest from Stern School’s Roubini…… He echoes a familiar refrain – central banks are “damned if they do, damned if they don’t.” Roubini has recommended gold for defensive purposes consistently over the past several months.

[ad_2]

Source link