Financial Times/Valentina Romei/11-14-2022

“The US Federal Reserve, European Central Bank and Bank of England had given a ‘clear signal’ that ‘we’re coming towards a period of slower tightening, mirroring what we’ve seen from Australia, Canada and Norway’, said James Pomeroy, an economist at HSBC.”

USAGOLD note: What Financial Times suggests is more a central banks’ downshift than applying the brakes. Though the impact is not likely game-changing, it indicates a willingness to moderate its approach in the face of recession concerns. It is difficult to know with the information available if Pomeroy’s views are on the money or a case of wishful thinking. At the same time, we continue to believe that should a financial or economic crisis develop, central banks would reverse policy quickly without too much in the way of regrets, as the Bank of England recently demonstrated.

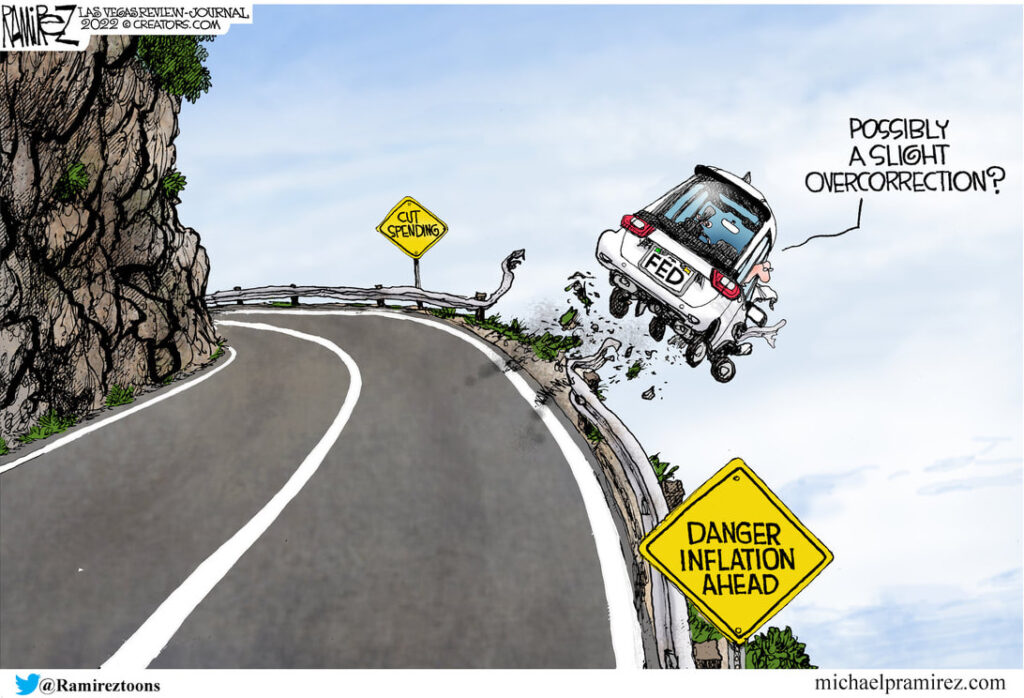

Cartoon courtesy of MichaelPRamirez.com