Jim Grant on Gold’s Central Bank Buying and Possible Revaluation

Authored by Goldfix

Jim Grant is writing about Gold again in his erudite historian way. In a brief but tightly-worded comment in this week’s Interest Rate Observer he touches on: The press infatuation with pronouncing Gold dead, Central Bank purchases and history, Gold’s performance in 2022 as inflation hedge (not so good), the potential for European Central Bank revaluations (pretty good) and more. Here is an attempt to summarize and decode some of it.

The writer starts off noting the absolute pessimism by the press. He takes a jab at the one-upsmanship by publications to see who can deride Gold the most. He quotes both Bloomberg and Business Insider one day apart

“Gold set for its longest monthly losing streak since the late 1960s,” was the headline over a Halloween Bloomberg bulletin. “Gold prices are down for seven consecutive months, the longest decline since 1869,” Business Insider reported the next day..

Business Insider, he observes in the game of Gold-bashing media poker was, “seeing” Bloomberg and raising the date by 100 years. After which he admits he has been a friend to Gold for quite some time.

On Gold as an inflation hedge he self-effacingly notes: Everyone knows that inflation isn’t just bad for the bond market. What not everyone had realized is that inflation is also bad for the gold market, yet so it’s proven in 2022. One cannot argue against that based on the numbers so far. But, at some point those money market rates, if they keep climbing will begin to tear at the structure of credit itself, which he believes will happen.

In other words, at a point, there will be no interest high enough to make someone hold dollars as compensation for accelerating debasement. To our ears, he is describing what happens when a CB chooses to chase inflation (Burns) rather than over come it like Volcker did. Money markets giving over 4% now makes them fetching by comparison to the pet rock yielding nothing for now.

When that isn’t enough he says:

[G]old’s very sterility—no coupon, no counterparty [risk], no embedded options—may seem plenty fetching in its own right.

Next up is his summary of the WGC report on CB buying in 2022.

The World Gold Council reported that, central banks, led by Turkey’s, have purchased 673 metric tons of gold, “higher than any full year since 1967.”

This, he notes is the same year in which Chairman William McChesney Martin admitted to the rest of the FOMC that: “the horse of inflation not only was out of the barn but was already well down the road.”

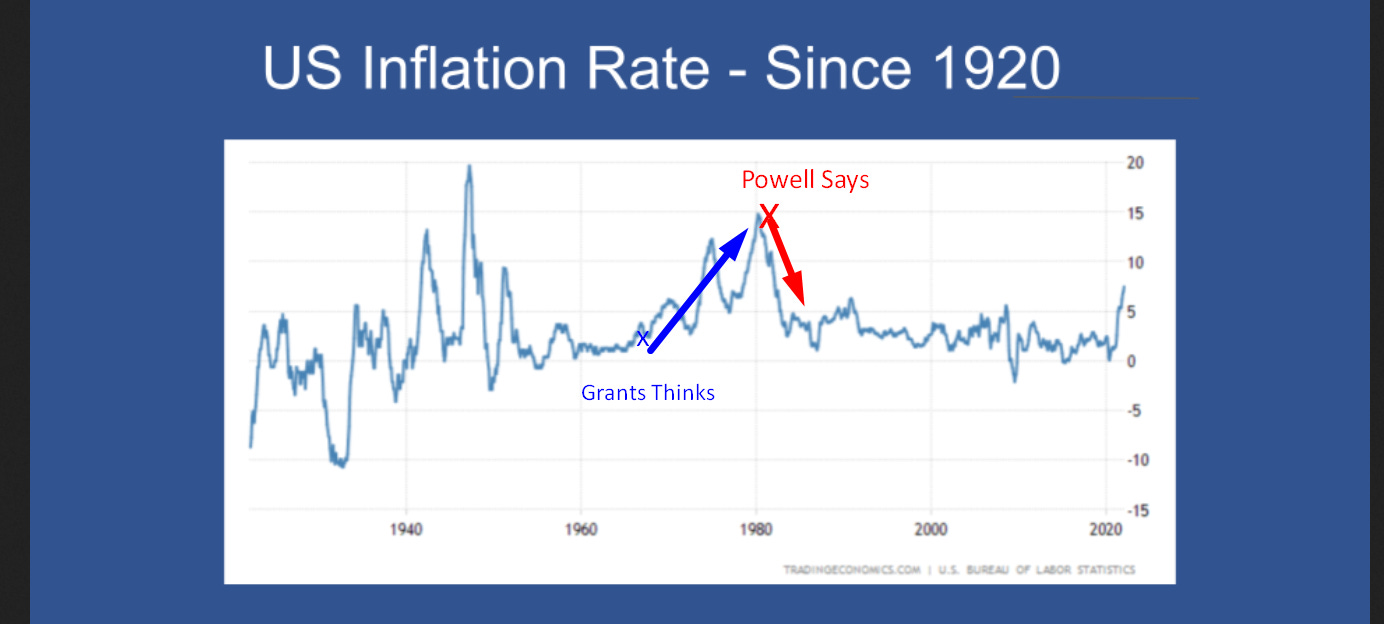

Given his inflationary timeline starting at 1967, it might be worth while seeing how that compares to the more popular Fed Chair analogs.

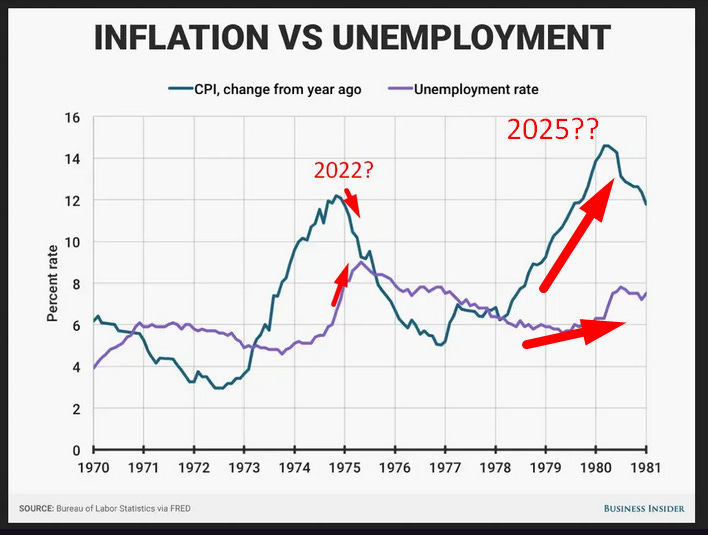

When one thinks of past parallels McChesney Martin doesn’t jump out. But maybe he should. Let’s consider the two most common scenarios (Volcker and Burns) making the rounds in comparison.

In the first one the Fed and financial media would like you to believe the ghost of Volcker has been summoned and the recent hawkish vibe is 1982 all over again. This Volcker-signalling implies the end of inflationary pressures are near of course. Maybe that is right . But odds are against it given the political pressures and the sheer magnitude of the global debt in economies now.

In the second scenario some, like us, believe we are witnessing the beginning of a lull in inflation not unlike between 1975 and 1976 before the real ramp-up. One indication of that process would be the US inflation target raised as an admission of inability (or unwillingness) to actually kill inflation. To that point, late last month the Fed started publicly (through leakers) testing the waters for higher inflation tolerance with statements like: Either inflation [ is allowed to] normalize at a significantly higher baseline, unemployment normalizes as being “full employment” closer to 5 or 6%, or we get a torrid stagflationary recession worse3 than the 1970s as the market resets itself –Source

We got out of the inflation in 1976, lets let it run again boys…

What can raising the target mean if not admitting they are chasing inflation, like Burns, and not willing to catch up? We believe the Fed, even if they truly intend to, will do the right thing only until they can do the wrong thing again. This all from political pressures and neo-keynesian genetics. But we feel Jim Grant has a third analog scenario implied by his 1967 comment on his mind.

Grant noting timing similarities between 1967’s William McChesney Martin comment and CB buying seems even more pessimistic Who are we to say he is wrong? Especially in light of the fact that Central banks are even considering re-valuing their Bullion at market prices to cover for their monetary screw-ups these past 10 years. That to us is similar to going off a Gold standard in 1971 after not being financially responsible for a generation. They are rationalizing their losses by once again raiding the piggy bank, not reducing the debt.

If Jim Grant is right, 1967 is a long way from 1982…

Why would Central Banks in Europe consider re-valuing their bullion at market prices now? To make up for the shortfall in funds lost from the Bonds they have bought the last 10 years during the QE and MMT experiment is why. To shore up their mismanaged balance sheets. Here’s Grant (emphasis ours):

Klaas Knot, president of the Dutch central bank, recently speculated on the possibility of his bank, and perhaps other European national central banks, marking up their gold to current market prices (as opposed to what we gather is the standard $35-per-ounce carrying value). They would so mark to supplement the capital they’ve lost on their QE-era bond portfolios.

We would note that the central banker voluntarily brought this up on his own in that interview. Ambrose Evans-Prichard stated last Monday what many of us have been thinking: What if this is the tip of the iceberg?

“The [Dutch central bank] is exploring a revaluation of its large gold reserves as a ‘solvency backstop.’ If the Dutch are having to do this, we can be sure that weaker central banks in the ECB network are in worse shape. It is likely that gold reserves will have to be mobilized in several states to boost equity capital. The barbarous relic may get its revenge on fiat paper.”

Finally Grant wonders aloud, While the Fed’s balance sheet shows $11 billion of “gold stock,” America’s central bank owns not one ounce of gold. It exchanged its bullion years ago for a note from the Treasury. Not a good trade, Knot might agree.

If the price of gold is the reciprocal of the world’s faith in the capacity of the stewards of paper money, what does it say when those very stewards are looking at it publicly as a go-to solution for what ails them?

Subscribers (ZH Special rate) continue reading here including footnotes

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link