UMich Sentiment Slides In November, Inflation Expectations Steady Near Multi-Year Highs

As has been the case in recent months, the headline sentiment signal from UMich pales relative to the survey’s measure of Americans’ inflation expectations. This is the final print for November was the same as the flash print for the medium-term (3.0%) but the short-term (1Y) expectation dropped modestly from 5.1% to 4.9%…

Source: Bloomberg

The final headline sentiment print for November rose from the flash print (56.8 vs 54.7) and was better than expected as ‘expectations’ rose significantly from the flash print. The headline (and the two sub-indices) did all drop however on the month with current conditions tumbling from 65.6 to 58.8

Source: Bloomberg

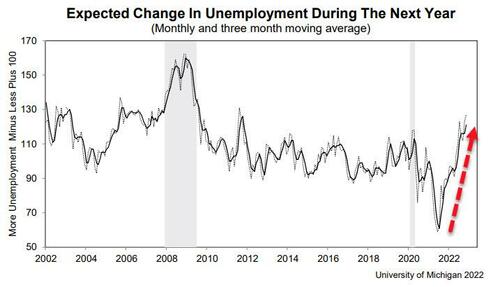

Along with the ongoing impact of inflation, consumer attitudes have also been weighed down by rising borrowing costs, declining asset values, and weakening labor market expectations.

Buying conditions for durables, which had markedly improved last month, decreased most sharply in November, falling back 19% to its September level on the basis of high interest rates and continued high prices.

Source: Bloomberg

The Fed is working its magic on Americans’ sentiment for sure.

[ad_2]

Source link