JPM’s 2023 Gold & Silver Outlook Says $1860 and $25.10

Authored by Goldfix

JPMorgan’s Annual Base and Precious metals Outlook was released to clients yesterday. For base metals, the bank sees 2023 as a year that will require tactical positioning and adept timing to navigate. They see metals retesting lows sometime in midyear as China’s reopening can be perpetually glitchy. They like Copper, but still think new lows are on the table in Q2 2023. The bank thinks better of precious metals and for a change are pricing Silver to outperform Gold in Q4 2023. The key to all this is their belief that the Fed will be cutting rates by end of year 2023. Below are some highlights and comments on that report.

After forming a volatile bottom in the coming months, we see gold prices recovering over the course of next year to average $1,860/oz in 4Q23.

Key Takeaways:

- Falling real yields and an unwind in stinging dollar strength will likely “open the upside for gold prices over the later stages of 2023″.

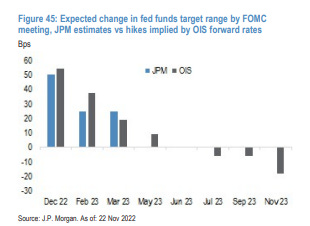

- JPM’s economists forecast the Fed will ultimately pause rate hikes in March

- Even with a bullish baseline forecast, they think risk is skewed to the upside in 2023.

More volatile silver forecasted to follow gold higher over 2H23, jumping to a 4Q23 average of $25.1/oz.

Key Takeaways:

- Very strong Indian demand has been a key at insulating the downside in silver over 2H22

- Moreover, with China more fully reopened [Edit- by Q4 2023 hopefully- GF] and its industrial demand expected to be hitting full stride, we think silver could outperform gold as both rally into year-end 2023

- The gold-to-silver ratio should fall towards 74.

Platinum looks primed for a bullish recovery over 2023 and is among our top picks for upside next year across metals….In contrast, we remain structurally bearish on palladium over the medium term and expect a further correction lower in prices over the course of 2023 and 2024

The Buy Season reports we promised would happen are now coming out. Know that based on this JPM report, the Goldman report we reviewed 2 weeks ago here and both metals’ (short covering) strength the last 2 weeks we can say the following with very high confidence:

- Some of that short covering last week was triggered by smart money buying early

- The banks think the Russian selling is done for now but may come back in Q2

- The sellside desks expect allocations to metals to increase at expense of crypto and maybe oil, but against the backdrop of higher rates, not much more money to go around

- Absent an exogenous event how much these markets rally (if they do) between now and February will be almost entirely based on how the current longs accommodate the new money coming in.

- CAVEAT: Always be aware when a bank’s recommendations are for a late year rally as this report (note the subtitle) is calling for when it is very consistent with their interest rate outlook in same year. They are also bullish stocks and EMs we’d guess but do not know.

The real reason JPM is bullish Gold…

These things are on our radar:

- The collapse of Crypto in 2022 will be a tailwind into Metals. Not so much for crypto money coming out and being reallocated (there is little left after US Crypto ETF buy-ins got decimated) towards Gold, although that will happen. But for the money at the margin that is undecided on Gold versus Oil versus Crypto. People are very scared of counterparty risk now as evidenced by the removal of bitcoin from custodian accounts due to the FTX scandal. Gold is much more easily understood in times of rampant financial/political fraud and distress. Crypto will stop cannibalizing Gold as an alternative. This will directly benefit GLD despite its own ETF related risks

- We remember very clearly last year JPM made an offhand public comment on how they advised institutional clients to put money back in gold and take it out of crypto. Gold had a $40 reversal that day and gave JPM a proof of concept. Keep an eye open for that

- If our clients were long oil for a couple years on our say so, they might be convinced to sell a little of their oil and buy some Gold with the proceeds. Seems smart

Indian demand is well known now by major market participants. There has been a theory circulating that India was buying some silver for another BRICS participant. We subscribed to it as well, since it just seemed.. Continues…

Continue (ZH Special rate) reading here including footnotes.

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link