The Skyrocketing Unaffordability of U.S. New Homes

Unexpectedly Intriguing!

One month after setting a record low level for affordability, the unaffordability of new homes in the U.S. has skyrocketed.

The mortgage payment for the median new home sold in the U.S. during October 2022 would now consume nearly half the monthly income of an American household earning the median income. The following chart illustrates that development.

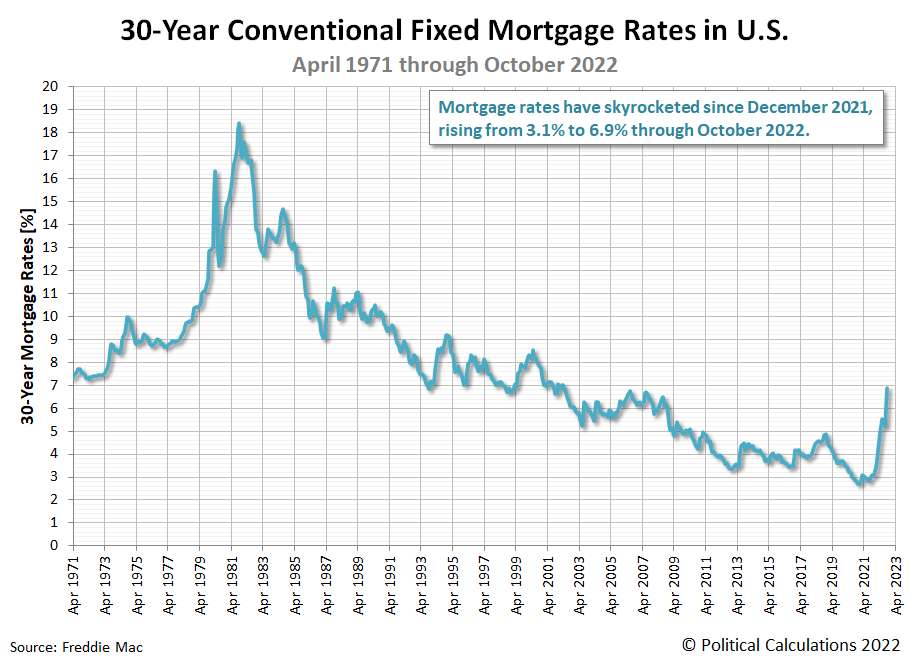

This negative change is primarily the consequence of rising mortgage rates, which have been pushed upward as the U.S. Federal Reserve has sought to make borrowing more expensive in its attempt to stall and reverse President Biden’s inflation in the U.S. economy. The next chart shows how mortgage rates have exploded during 2022 in response.

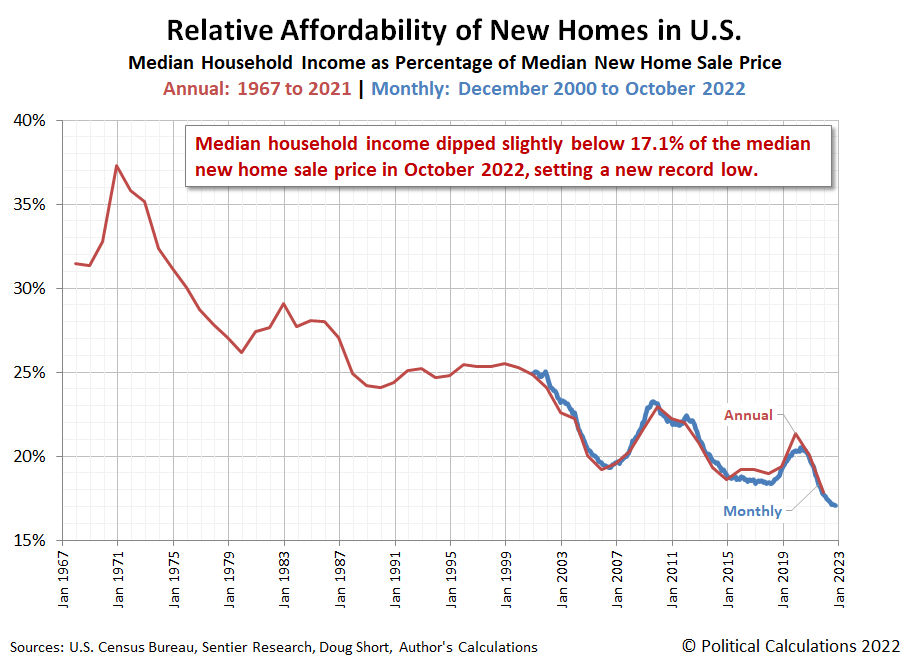

As mortgage rates have exploded, median new home prices have remained elevated, holding down their raw level of affordability with respect to median household income itself. The third chart confirms the raw affordability of new homes has hit a new low in that measure.

October 2022’s estimated median household income of $78,595 would only cover 17.06% of the sale price of the median new home sold during the month. New homes have never been less affordable for the typical American household.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 November 2022.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 November 2022.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 23 Novemmber 2022.

Political Calculations. Median Household Income in October 2022. [Online Article]. 1 December 2022.

Labels: inflation, personal finance, real estate

Welcome to the blogosphere’s toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations.com

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best

free resources on the web is available at W3Schools.com.

Other Cool Resources

Materials on this website are published by Political Calculations to provide visitors with free information and insights regarding the incentives created by the laws and policies described. However, this website is not designed for the purpose of providing legal, medical or financial advice to individuals. Visitors should not rely upon information on this website as a substitute for personal legal, medical or financial advice. While we make every effort to provide accurate website information, laws can change and inaccuracies happen despite our best efforts. If you have an individual problem, you should seek advice from a licensed professional in your state, i.e., by a competent authority with specialized knowledge who can apply it to the particular circumstances of your case.

[ad_2]

Source link