Deflation Is No Longer A Prediction, It’s A Fact. Negative 1.2% In November.

ugurhan

I won’t bury the lede. Core inflation has gone negative for both October and November if one employs non-lagging metrics for Owner’s Equivalent Rent [OER], which makes up roughly 40% of core inflation. I previously wrote about the possibility of deflation coming perhaps as soon as early next year. This article builds on that one, so you can check it out if you want to.

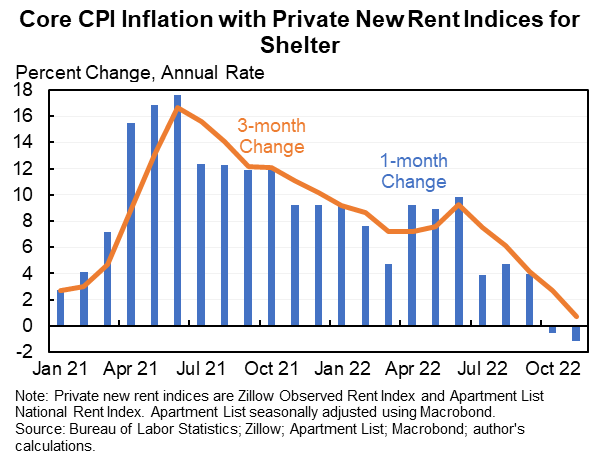

It turns out I overestimated how long it might take in my first article. Deflation is here, right now. Here’s a chart from Harvard economist Jason Furman, showing the effect, updated to include the inflation data release this morning. Barely negative in October, and negative 1.2% in November.

Jason Furman

The importance of non-lagging rent

The US Federal Reserve’s preferred inflation metric is “core inflation”, and roughly 40% of this metric is the OER, which is essentially a measure of the average rent paid by US renters. OER is unfortunately a lagging indicator, since rents go up slowly as people sign new leases. If the rental market were to head sharply higher, it still takes a while before average rent metrics have time to catch up to reflect this.

One way to reduce the lag, and to get a more current view of inflation today, is to replace the OER with the average rent paid for new leases, for example using only those signed within the last three months, or even the last month. Harvard Economist Jason Furman has done exactly that, using private market rent indexes provided by e.g. Zillow, and created the more current core inflation picture seen in the graph above.

Why Core inflation?

Core inflation is similar to headline inflation but excludes food and energy. Economists look at core inflation because they believe this provides information about the underlying economy, and is therefore better suited than so-called “headline inflation” when making decisions on Fed policy. Here’s Nobel Prize economist Paul Krugman on this point:

The reason the Consumer Price Index affects expectations about policy is that it’s supposed to be an indicator of how overheated the economy actually is. We’ve long known that the raw inflation numbers are poorly suited for this purpose. For example: Inflation caused by things like Russia’s invasion of Ukraine isn’t telling us about slack in the U.S. economy. So the Fed has long relied on “core” inflation, which excludes volatile food and energy prices.

The Fed, from 2021 until now

There can be a fixation on fighting the last battle. In 2021, the Fed and many others were worried about deflation, to the point where they provided epic levels of stimulus. Inflation was not front and center, not in the news, and not, apparently, a major concern at the Fed. So it was “pedal to the metal” stimulus, even though unemployment was low and shrinking, and GDP was growing, and inflation was quite high. The Fed guessed that the inflation would be transitory, and they guessed wrong. Inflation was a risk then, but not one they were paying as much attention to, perhaps, as they should have.

And now the situation is reversed. All we see in the news is inflation, and the Fed is, in my view, clearly very focused on it. Deflation is now the risk that is being ignored, and this was true even as evidence began to mount that it might once again become an issue. And now, it has.

Conclusion

Deflation, using non-lagging metrics for OER, is literally here right now. We see negative core inflation in October, and then a bit more in November. Perhaps it will prove transitory. I don’t know if it will or not.

This seems important. I don’t think it should be ignored.

[ad_2]

Source link