Initial Jobless Claims Unexpectedly Tumble To 3 Month Low

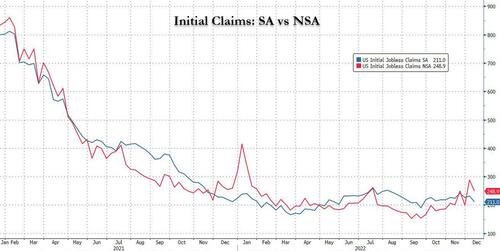

Thousands of tech workers laid off every single week as the Silicon Valley ponzi crumbles under the weight of the Fed’s rate hikes? Not according to the Department of Labor, which moments ago reported that in the latest week, initial claims unexpectedly tumbled by 20K to 211K from 231K, the lowest since September 23 and far below the consensus estimate of an increase to 233K; at the same time unadjusted claims dropped from 288K – the highest since January – to 248.9K.

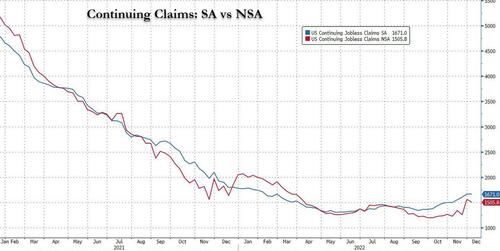

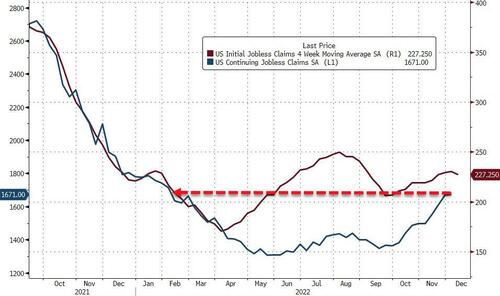

Meanwhile, continuing claims continued their ascent, and in the latest week rose from 1.670MM to 1.671MM…

… which while also missing the exp 1.674MM was the highest print since February.

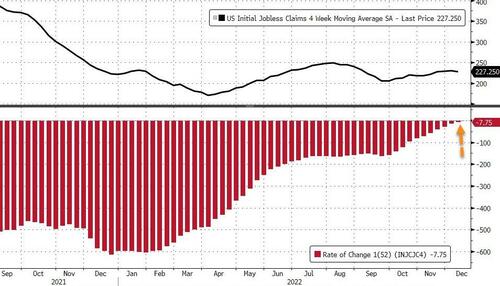

On a 4-week average basis, initial claims are almost back to unchanged on a Y/Y basis, although it is safe to say that there was a pronounced seasonal component to today’s unexpectedly strong print.

On a state by state basis, there was a big reversal of last week’s surge in claims, with New York seeing a solid 6.9K decline in claims while not a single state posted a more than 418K increase in claims in the latest week.

So just as sliding JOLTS job openings data series and the Household survey both scream labor market slowdown, the Dept of Labor decides to throw in yet another stick in the spokes of the Fed’s induction machinery, and hits pause – if only for another week – on expectations that the job market is heading for a recession. That this is not good news for stocks is obvious: only look at futures sliding since the print to fresh lows is all you need to know.

Loading…

[ad_2]

Source link