Goldman Sachs to lay off up to 4,000 people

Goldman Sachs plans to lay off as many as 4,000 employees as it struggles to meet profitability targets and retreats from its gamble on Main Street banking, people familiar with the matter said.

Managers across the firm have been asked to identify low performers for what could be a cut of up to 8% to its workforce early next year, the people said, with some cautioning that no final list has been drawn up.

Those cuts appear to be much deeper than ones taking place at other Wall Street firms like Citigroup, which is letting go of dozens of staffers amid a market downturn, and Barclays, which is laying off about 200 people, CNBC reported.

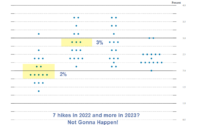

In a typical year, between 2% and 5% of Goldman’s employees are laid off or receive no bonus — “zeroed out” in industry parlance, a clear sign to start looking for another job. Like other firms on Wall Street, Goldman skipped these cullings in 2020, because the pandemic made them insensitive, and in 2021, because boomtime profits made them unnecessary.

Now, though, CEO David Solomon is falling short of a profitability goal he set in February. The dealmaking and fundraising booms have vanished, and Goldman’s big bet on consumer banking hasn’t paid off. The firm has lost billions of dollars building a tech-forward Main Street bank, called Marcus, that isn’t yet profitable.

Goldman’s workforce has swelled by a third since Solomon took over in 2018 to more than 49,000 now, largely due to a hiring spree in engineering and Marcus. Acquisitions added some, too: GreenSky, a specialty lender, had about 1,000 employees when Goldman bought it earlier this year.

[ad_2]

Source link