Lawrence Lepard: “We are never going back to 2% inflation. That’s just not happening.”

Late last week, fund manager Lawrence Lepard talked about the current state of affairs with the Fed’s monetary policy, and how it will and won’t get inflation under control in the coming months.

In a conversation with Chris Marcus of Arcadia Economics, Lepard discussed how the precious metals are acting as a discounter of Fed policy (“Gold tends to look around the corner”), if he thinks a true pivot is coming (he does), some interesting parallels with the 2008 panic in financial markets, and how that got resolved.

Ultimately, he thinks gold and silver are sniffing out the real pivot, and if gold gets above the $2070 level, this time it will be for the right reasons. With the main reason being, the Fed will be forced to tolerate higher base inflation because a crashing economy will take precedent.

Interesting to us is Lepard’s succinct explanation as to Why a pivot will come. He lays out the political problems associated with Powell’s position, and the most likely way it gets resolved. Of particular interest was when the interview turned to discussing inflation vs. broken markets against the current backdrop: essentially a timeline of Where We Are, Where We’re Going, and How We Get There.

Where We Are – Economy Crash Risk

In response to the question “are you surprised there hasn’t been a break in the markets yet given all of the hikes,” Lepard acknowledges slight surprise, yet then proceeds to draw some interesting parallels between Bear Stearns/Lehman and the recent UK Gilt disaster.

The Gilt rescue was “a big clue,” and may actually have been the Lehman moment for the UK (although we would note the Fed did open a window for USD to the EU immediately afterwards).

When asked about the economic situation as it currently exists, he paraphrases a recent comment by Mohamed El-Erian:

‘The Fed slammed on the brakes, and the economy is in the process of going through the windshield.’

He goes on to note other cracks that have shown up in the financial markets, and implies these are the reasons the Fed has backed off, and will continue to back off on hikes.

When something likely breaks they cannot paper over publicly, the Fed could have to pivot quite aggressively in Q1 or Q2 next year. The only caveat being that it took 15 months to get Lehman after Bear Stearns collapsed…so it takes time.

On monetary data he says this: The Fed’s remittance to the treasury has gone deeply red. In other words, the Fed is losing money now. And if the Fed is losing money, the rest of the economy is not far behind.

‘Everybody in this economy is out over their skis in terms of free money, and the money is not free anymore.’

All of this adds up to a higher tolerance for inflation. It’s where this has to go.

Where We Are Going – Higher Base Inflation

In regards to higher base inflation, Lepard states unequivocally:

‘We are in a new inflation environment. Inflation will wax and wane. But in my opinion we are never going back to 2%. That’s just not happening.’

If the economy is rolling over, government finances will get worse, which means they will have to sell more bonds to bridge the gap. To that point he notes: the budget deficit was over $1.3 trillion in 6 months, tax receipts were down 10%, and expenses were up 6%.

That’s not a good mix.

QE: the cause and cure for all our worries…

These problems foretell that it’s just a matter of time before the rate policy shifts. When it does, the government will be forced to tolerate higher base inflation just to keep things somewhat normal otherwise.

All these emerging cracks must be managed, and at some point it will become too much. Lepard notes when that happens, ¨even if inflation is somewhat hot.. they will have to go back to printing.¨ Lepard believes the rate hikes will continue to slow down. He sees the Fed backing off hikes to not break the market, but it will likely happen anyway. That’s when the aggressive pivot comes.

How aggressive depends on how big of a break.

How We’ll Get There – Premature Victory

The Fed is heavily influenced by the politics surrounding inflation and will continue to “fight” it; that is, until the media headlines drop “inflation” and change the narrative to “unemployment and the economy”.

Then it’s pedal to the monetary metal again.

He maps it out pretty clearly. Going forward, if nothing breaks that can’t be hidden, the following will likely happen in short order:

- “First they’ll get some decent inflation news.”

- “Then they’ll redefine the inflation target upward from 2% (The Brookings institute in September started pushing for just that)

- ‘The headlines will go from inflation to unemployment,’ and the political agenda will shift again.

Suddenly unemployment and the economy will become a bigger issue for everyone, and the Fed will be back at the printing presses pretty quickly.

We agree, and said so on several different occasions, noting Two Percent Inflation is a fairy tale. If the Fed does not get real rates above inflation (they haven’t), it will translate into inflation during the next recovery that’s much higher than during the last recovery from 2010-2019. This is not a policy bias ending well.

On Gold and Silver

As to gold’s potential he summarizes it as such:

‘There’s about $450 trillion of financial instruments in the world, and only $5 trillion worth of tradable gold. Imagine if only 10% of that decided it had enough of depreciating values. The buy-in to gold would be monstrous.’

Which makes enough sense. Although is there a scenario in which his thesis could be wrong?

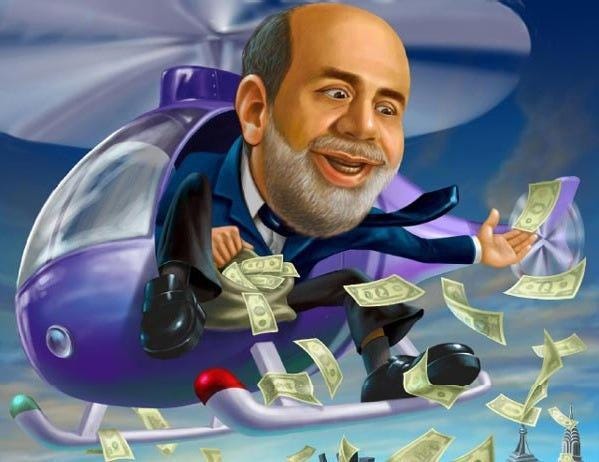

Arcadia’s ‘Helicopter Ben’ in pure silver… (yes the rotors spin)

If the US government got very disciplined (which Lepard notes is unlikely), it’s possible. We would say though, and believe he would agree, if the government decided to get disciplined under the current backdrop, we would have a much bigger problem.

The Administration will jam the numbers to fit the narrative. Governments always mess around in markets, but the level has gotten enormously larger in recent years.”

Given the above, the only way through hell for the Fed is to put us through hell along with them. Which is why so many like Lepard turn to gold and silver.

Full interview and more here

Lawrence Lepard:

Chris Marcus:

[ad_2]

Source link