Zoltan Pozsar’s Gold-mageddon Deconstructed | ZeroHedge

Authored by Goldfix

“[B]anks have been managing their paper gold books with one assumption, which is that [Nation] states would ensure gold wouldn’t come back as a settlement medium.” -Zoltan Pozsar

Before we go any further, we read ZeroHedge’s report on this letter Dec 7th entitled: Zoltan Pozsar: Gold To Soar…When Putin Unveils Petrogold (ZH Prem) and have been thinking on it since. Here is one of those thoughts pertaining to Gold’s evolving market structure

The statement at top is arguably the most important sentence in Zoltan’s recent post entitled: Oil, Gold ,and LCL(SP)R. It is how he closes that note.

If you have read his letter (excerpt below) you may prefer quotes pertaining to Gold’s price jump from $1800 to $3600 or Pozsar’s follow up statement to the price of Gold potentially doubling where he wrote: Crazy? Yes. Improbable? No.

Those statements certainly are nice to read for real-money advocates; especially coming from one of the most respected economists on the street these days. We cannot lie it makes us smile as well.

However, for anyone with precious metals exposure, like a bank or presumably you reading this piece (thank you for that), the quote at top should rule them all. Here’s why…

Zoltan, possibly inadvertently, gives readers the rationale by which banks have been profitably shorting Gold since the 1990s. Here is our translation of that same sentence at top.

Translated from the original Zoltanese:

Banks have been using rehypothecation for decades fearlessly with approval of global governments who promised them Gold would never be used as a settlement medium—i.e. have a practical use — again.

Here’s how a Global head of Gold and Bond trading once explained it to us: Gold? We can short it until the cows come home. Why? Because not only is it unconsumed/indestructible, it isn’t used for anything anymore. Its price is how much more USD money we have to pay you to delay delivery. It’s a collectible, a pet rock, and nothing else. Short it. Government can’t let it back in as an MOE. If they did it would destroy them. If we go under, they go under. . But I still love Gold. I get to screw the other banks when they get too short every so often.

By inference Zoltan is telling us what Banks and Nations fear; That being Gold-as-settlement-medium concept returning.

Its return as settlement medium would coincide with the reduction of Bank rehypothecation carry trades as both cause and effect of Nations needing to actually use Gold in deals again.

Ultimately the root of banking’s short Gold bias is the fact that no-one needed Gold in hand for anything that cannot be delayed until later by paying them more USD to defer.

This was memorialized in the global market structure by the combination of several things. Chief among them was permitting unlimited rehypothecation (invented by Gold longs, not shorts BTW), changing tax and collateral status (it’s not money, its an asset, Tier 3!), and replacing it (Bretton Woods and its 1971 demise) as the preferred MOE. Once these were done its remaining value as an SOV was an abstraction they could handle. They probably thought: Let it remain an SOV, like art and ceramic figurines. We don’t care. And that is how it has been for decades; until now.

Therefore as Gold owners, traders, and students of economics, we want to know what would entail Gold actually becoming a settlement medium again.

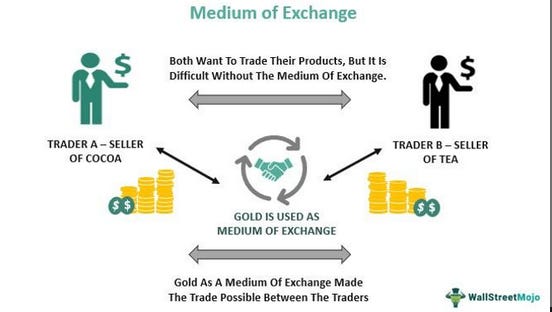

The first question for us in pursuing that goal: What is a settlement medium?

Here is “settlement medium” in Zoltan’s context again:

[B]anks have been managing their paper gold books with one assumption, which is that [Nation] states would ensure gold wouldn’t come back as a settlement medium. -Zoltan Pozsar

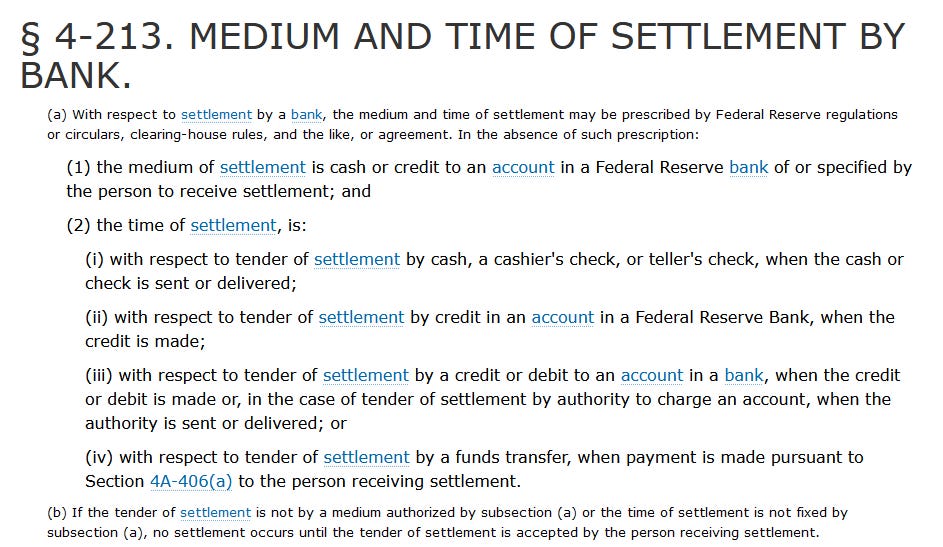

Turns out “settlement medium” is Federal reserve jargon from the UCC: “Medium of settlement is cash or credit to an account in a Federal Reserve bank of or specified by the person to receive settlement.“ –§ 4-213.

In other words, settlement medium means: Medium of Exchange (MOE). Gold, Pozsar is telling us, is in danger of once again competing with the USD as an MOE. Pet rocks aren’t supposed to have use-cases. But Gold is perfect for this use case.

Gold, Zoltan implies, is reemerging as an MOE competitor to dollars for deals. Why does that matter? Using Gold directly means using less dollars. It’s one thing to use gold as a store of value (SOV) as it continues to be held by central banks worldwide for “tradition” sake.

Classic pic.twitter.com/T30vDBTI2j

— VBL’s Ghost (@Sorenthek) December 17, 2022

Before we get to the rest of the sentence, we have to do justice to Pozsar’s Armageddon scenario mentioned prior and what the whole Gold/Fiat world are atwitter over. This is what he said:

War is not about gentlemanly conduct…

The cap of $60 per barrel for Russian oil equals the price of a gram of gold (at current market prices). Let’s imagine this set up as a peg. The G7, led by the U.S., effectively pegs the U.S. dollar to Urals at $60 per barrel. In turn, Russia pegs Urals to gold at the same price (a gram of gold for a barrel of Urals).

The U.S. dollar effectively gets “revalued” versus Russian oil: “a barrel for less”. The Western side is looking for a bargain, effectively forcing a price on the “+” in OPEC+. But if the West is looking for a bargain, Russia can give one the West can’t refuse: “a gram for more”. If Russia countered the price peg of $60 with offering two barrels of oil at the peg for a gram of gold, gold prices double.

Russia won’t produce more oil, but would ensure that there is enough demand that production doesn’t get shut. And it would also ensure that more oil goes to Europe than to the U.S. through India. And most important, gold going from $1,800 to close to $3,600 would increase the value of Russia’s gold reserves and its gold output at home and in a range of countries in Africa. Crazy? Yes. Improbable? No. This was a year of unthinkable macro scenarios and the return of statecraft as the dominant force driving monetary and fiscal decisions.

Let’s game this Gold-mageddon scenario out briefly and describe what would happen if such an event occurred…

End Part 1

Follow VBL’s Ghost on twitter

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link