As the year draws to a close, with most looking to remove 2022 from the ledger altogether and certainly from audited fund track records, it seems far from over given the moves we still are witnessing.

The broader equity markets have rallied from the October lows, taking a host of other asset classes up with them, but now are giving up most of those gains bar a few. Gold and silver have rallied 10% and 20%, respectively, while most equities, especially technology stocks, are turning back down. This dichotomy begs the question, “What exactly is it that gold and silver know that other markets don’t?”

As 2022 started, the prevalent theme in the market was one of higher if not secular inflation. On back of that, gold and silver were two assets that were predicted by most to be the top performers of the year as they tend to thrive in an inflationary cycle. However, gold and silver are more or less flat for this year, and only have performed better in the last few months after declining most of the year.

Their performance came as a shock to most as inflation was averaging close to 10% year over year at the beginning of the year. Even central bankers who declared inflation was transitory now have turned in their chips, saying they got it wrong and that inflation was here to stay. Why, then, did gold and silver perform so badly when it was truly their time to shine?

The analysis depends on which currency one looks at and whether it is an absolute game or a relative one. Gold and silver in dollar terms may have fallen quite a bit this year, but in euro, sterling or even yen terms, they were up in multiples. It is just that most are used to looking at commodities in dollars and hence the performance metrics seem a bit tainted.

Global asset managers, if they were smart enough to hedge their precious metals positions out of dollars, would have nothing to complain about. So it is not just the absolute direction but also which currency one holds an asset in that dictates overall performance.

In addition, even though equities and bonds are down 20% this year, gold still outperformed most assets on a relative basis. But then again, most hedge funds are absolute return vehicles, so this may not help their cases.

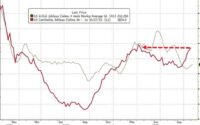

The most important factor that kept the prices of precious metals and commodities in general lower this year was the dollar. The U.S. Dollar Index (DXY) was up around 20% at its peak of $114 in October, at the height of Fed hiking cycle, but since has fallen to the calmer $104 level.

After the excess stimulus of the post-Covid boom, inflation kept reporting drastically higher month-on-month prints, leaving the Fed no choice but to start raising rates in clips of 75 basis points given that rates were starting from an absolute level close to 0%. The Fed knew that if things got really bad, which always happens at the end of every rate hike cycle, it would not have much room to cut rates to help the economy if need be in the future. This aggressive rate hike stance along with a central bank caught firmly with its tail between its legs caused the dollar to shoot higher versus every other currency as most were still playing catch-up to the inflation cycle.

This sudden and long-lasting dollar rally is what caused gold and silver to hold back and fall along with other assets, especially as US 10-year bond yields shot upward of 4%. Bottoms-up fundamentals may bode well for the precious metals sector, but the macro was overall negative.

As we step into 2023, the big question now is whether the US dollar has ended its massive rally against most G10 currencies or whether this just a pause for a protracted phase higher. The dollar’s path will be the deciding factor for a host of asset classes into 2023, because the foreign exchange and bond markets are always the ones to lead, not the equities.