Michael Burry: “US Is In Recession, Fed Will Cut And Will Cause Another Inflation Spike”

In the waning days of 2022, one of the most bearish (and accurate, at least as far as last year was concerned) strategists, SocGen’s resident permabear Albert Edwards, laid out what he thinks will be the big surprise of 2023, which will be “a return to deflation fears as headline CPI inflation drops close to, or likely below zero. Investors are already anticipating recession and have an unusually strong preference for bonds.”

Edwards’ also expects that while the current recession and collapse in commodity prices will also cause headline inflation to collapse, core inflation will abate too but remain sticky around 3% due to residual wage-price inflation (justifying the inevitable change in the Fed’s target).

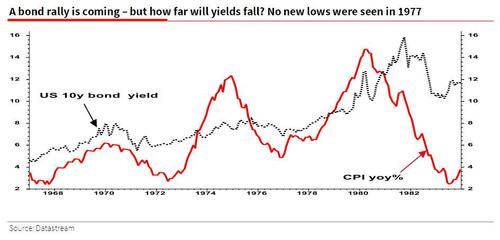

Which, to Edwards, sets us up for the worst possible scenario: a second wave of inflation, just like we saw in the 1970s under the Burns Fed, to wit: “any decline will be purely a cyclical phenomenon rather than a full-blown return to the Ice Age theme” and as a result, “investors have not yet discounted a second secular wave of inflation as we eventually exit this unfolding recession – ie the Great Melt.”

While Edwards is hardly alone in calling for a recession and a deflationary reversal of current soaring prices, following by an even more brutal inflationary wave as Powell reveals he was not Volcker by Burns all along, overnight another bearish icon repeated the exact same sequence of events.

Tweeting late on Monday, Scion Capital’s Michael Burry, aka “the Big Short” said that while inflation has peaked, it is likely to pick up again in response to the coming stimulus which will be unleashed to offset the painful 2023 recession.

“The US in recession by any definition,” Burry tweeted on Sunday, echoing Albert Edwards verbatim, adding that “Fed will cut and government will stimulate. And we will have another inflation spike.”

Inflation peaked. But it is not the last peak of this cycle. We are likely to see CPI lower, possibly negative in 2H 2023, and the US in recession by any definition. Fed will cut and government will stimulate. And we will have another inflation spike. It’s not hard.

— Cassandra B.C. (@michaeljburry) January 2, 2023

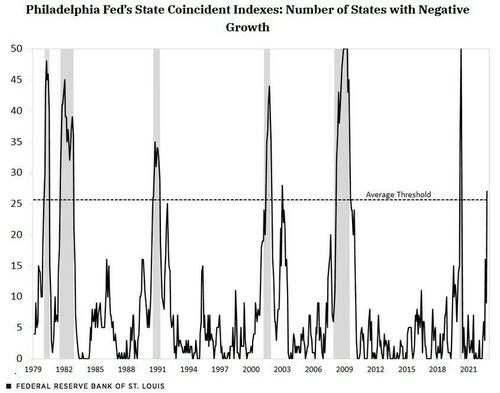

Burry is certainly right about the US being in a recession, especially now that more than half of US states have negative growth, a threshold that has always led to recessions in the past…

… the last, missing piece is the BLS admitting the US labor market is in freefall and now that even the Philadelphia Fed has opened up the pandora’s box over rigged jobs data, it is only a matter of weeks if not days before the Dept of Labor admits it made a “mistake.”

Where Burry is wrong is in expecting a government, or fiscal, stimmy. With Congress now divided at least until 2024, one can kiss any major, multi-trillion injection goodbye until after the next presidential election (absent a war with China of course). Which means the only stimulus for the next 24 months will have to come from the Fed, i.e., monetary, and thus will stimulate risk assets far more than the economy.

This was Burry’s latest warning since September, when the S&P tumbled to its 52-week lows, and when the Big Short predicted more pain for the stock market, saying “we have not hit bottom yet.” However, the weeks following the September dump saw stocks briefly soar into a bull market amid a powerful short squeeze expect a Fed pivot; it remains to be seen if stocks will take out

In the second quarter, Burry put his money where his mouth is, as his firm dumped all of its equity exposure besides one company. One quarter later, Burry was back in the market, adding to his GEO Group stake and opening new positions in 5 companies as we discussed at the time.

Loading…

[ad_2]

Source link