California lawmaker proposes ambitious wealth tax on state’s richest residents

California’s richest residents — and even those who move out of state — could be required to pay a new wealth tax as early as next year.

A new bill proposed by Democratic Assemblyman Alex Lee would tack on an additional 1.5% tax for Californians who have a worldwide net worth of more than $1 billion, beginning January 2024, according to KCRA-TV, the NBC affiliate in San Francisco.

An extra 1% tax would be added to those who make more than $50 million, beginning in 2026.

Mr. Lee said that the new wealth tax would affect around 23,000 “ultra-millionaire” and 160 billionaire households, according to The Associated Press

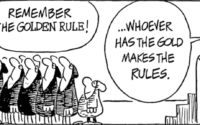

“Billionaires aren’t paying what they owe while enjoying public investments to build their empires,” Mr. Lee wrote Monday on Twitter. “Our modest 1% tax on fortunes of over $50M would generate nearly $22 billion a year – the same size of our deficit”

Calculating a taxpayer’s “worldwide net worth” would account for their annual income as well as diverse holdings such as farm assets, art and other collectibles, and stocks and hedge fund interest, according to Fox News Digital.

Moving out of state wouldn’t exempt wealthy residents from paying the taxes, either.

Taxpayers who don’t have the cash on hand to pay the wealth tax — because their assets aren’t easily liquidated — would be required to file annually with California’s Franchise Tax Board and eventually fulfill their wealth tax obligation to the state even if they no longer live in California, according to the bill’s language.

Mr. Lee has joined progressive lawmakers across the country who introduced similar measures in their state legislatures, including New York, Illinois, Hawaii, Maryland, Minnesota, Washington and Connecticut.

“The constant across all seven states, or wherever such taxes are proposed: wealth taxes are economically destructive, their base is almost impossible to measure accurately, and they create perverse incentives and promote costly avoidance strategies,” Jared Walczak, from the conservative-leaning Tax Foundation, wrote last week. “Very few taxpayers would remit wealth taxes—but many more would pay the price.”

California Gov. Gavin Newsom, a Democrat, has campaigned against raising taxes on the state’s wealthy residents.

The Golden State already taxes more than any other state in the country, according to the AP. The top 1% of earners account for roughly half of the state’s income-tax collections.

[ad_2]

Source link